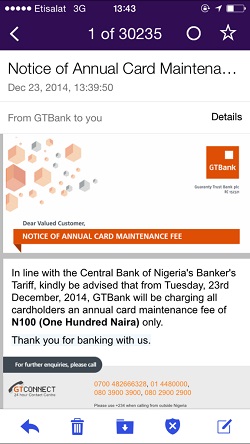

If you are a GTBank customer and hold a debit card from the same, you have probably received an email notifying you of an annual card maintenance fee of N100. This new fee is said to be in line with the Central Bank of Nigeria’s Banker’s Tarrif, and is effective from the 23rd of December 2014.

As far as I can currently confirm, only GTBank has sent this message. Of course, since this is a CBN directive, it is only a matter of time before all the other banks fall in.

The banks charge N1,000 every time they issue a new card. And new issues include replacing lost or expired cards. Each card has a term of four years, which means that in the end, a card that is carried to term will now cost forty percent more, or N1,400.

What is this charge for? We don’t know yet. We also don’t know how it will be divided between the CBN and the bank. Annual card maintenance charges are not mentioned in the Central Bank’s Revised Guide to Bank Charges, published in 2013 (PDF, see page 18 on electronic banking). But the guide couldn’t have provided for the relatively recent N65 charge for remote-on-us ATM withdrawals — that is the fee for withdrawing from an ATM that is not “your bank’s”.

That particular directive has been in force since September, and quite a few N65 debits on my account since then assure me that it’s real.

As of now we have not seen any official communication from the CBN about the new N100 annual card maintenance fee, but GTBank’s message to its customers is as good as any assurance that the CBN will be helping itself to a tidy Christmas haul from bank card users before 2014 is out. There are between four to five million GTBank debit cards in circulation, according to informed guesstimates by banking experts I have interacted with. A ThisDay report puts debit (ATM) cards in circulation at 26 million as at 2012. That would mean the CBN stands to rake in anything from N400 million from just GTBank, and more than N3 billion across the board.

Some of the early recipients of the notice are not too happy. Puzzled customers have taken to social media to kvetch about it. The new CBN Governer, Mr. Godwin Emefiele seems, in some opinions, very tariff happy. Others are laying their angst at the feet of GTBank, which seems to be the first and only bank as of this report to go public with the directive.

@gtbank : after charging fee on getting same card… Now it's time to charge #100 per customer…. What a Christmas take home.#Oluwa dey ooo

— babs babalola (@phobabs) December 23, 2014

https://twitter.com/Adacampbell/status/547373839500722177

We have contacted GTBank and the CBN for comment and await their response.

Photo Credit: Ciaran McGuiggan via Compfight cc