|

FEBRUARY 21, 2021

This newsletter is a weekly in-depth analysis of tech and innovation in Africa that will serve as a post-pandemic guide. Subscribe here to get it directly in your inbox every Sunday at 3 pm WAT |

|

|

|

What’s with the weather everywhere? There’s the harsh, unsolicited return of harmattan in Lagos; snow storms & power cuts in Texas; and severe floods in India and Indonesia. Is the ozone layer reacting to last weekend’s wave of Netflix and chill? We’ll reach out to the cloud for comments.

Speaking of Netflix, it’s been five years since they arrived in Africa with the promise of revolutionizing TV and film through the internet. Subscription estimates and local content production show that the motherland has embraced the novelty, but adoption lags behind other geographical regions.

So how will Netflix spur Africa’s growth to match global adoption rates? We peek through their milestones and recent moves for the big picture.

|

|

|

Wondering how best you can maximize your DStv subscription? Think DStv app!

The app is a convenient way to stream live TV, catch up on your favorite series, movies & sports highlights or download to watch offline.

With one subscription, an entire family can simultaneously watch different things on multiple devices.

Download from the play store or Apple store or visit now.dstv.com for more info.

|

|

|

Afro-flix, Vol. 1

On the first wednesday of 2016, Netflix launched its streaming video on demand platform in Africa. All 54 countries were welcomed on the same day. No tiered release to privilege countries by population, income, infrastructure or film industry maturity.

It was, shall we say, an ‘

Africa is a country’ strategy.

Five years later, the reality is different. Nigeria and South Africa define Netflix’s presence and prospect in Africa. Both leaned into historic filmmaking advantages to absorb the innovation more easily than others.

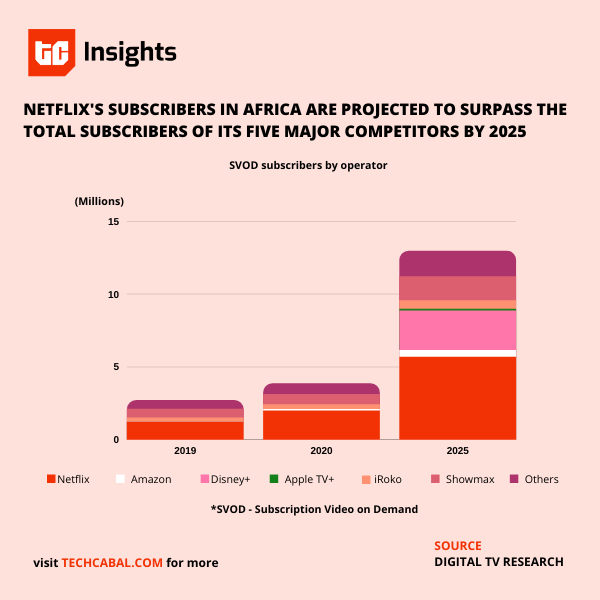

Digital TV Research, a London-based firm, estimates there were 1.99 million Netflix subscribers out of 3.86 million SVOD subscriptions in Africa at the end of 2020. They don’t have a per country breakdown but by 2025, South Africa and Nigeria are expected to add a combined 5.1 million subscribers to increase total SVOD subscriptions on the continent to 12.96 million.

|

|

|

South Africa’s

Queen Sono, Netflix’s first African original series, and Nigeria’s

Lionheart, acquired from actor/producer Genevieve Nnaji, announced Netflix’s intent on the continent.

Following the success of both major projects, Netflix plans to splash on more content in both and other countries.

But will the intended content blitz increase Africa’s Netflix subscriber contribution from the current 0.01%? It depends: on the company’s use of technology to solve access/cost problems, and country-specific macroeconomic factors.

In those 2016 days when they first arrived, Netflix counted on video compression technology to reduce the data African subscribers needed to spend to stream on the platform.

As such, recent improvements in compression technology, like Versatile Video Coding, will be music to Netflix’s ears. Shorter video load times, greater resolution, more bandwidth for internet providers and lower data costs.

But because this new compression tech is most useful with 5G internet connectivity, which will account for only 3% of African mobile connections in 2025, Netflix may not pin its short-term Africa growth hopes on compression. Instead, the company’s plan to break beyond South Africa and Nigeria will rest on bridge efforts like cheaper mobile-only subscriptions and enabling wi-fi downloads.

However, the success of these technologies will be challenged by something more fundamental: disposable income.

Nigeria’s annual inflation hit a four-year high of 16.47% in January; food inflation stands at 20.57%.

COVID-19 may have helped boost video streaming but it fueled an economic slowdown in South Africa in 2020. Unemployment reached a record 30.8% in Q3 and some economists warn that there will be austerity for several years.

The picture from these metrics is not pretty. There’s also the not-so-small matter of competition, from ShowMax and Iroko and eventually Amazon, Disney+ and Apple TV+. The latter three could reduce Netflix’s SVOD dominance in Africa from 51.6% in 2020 to 43.97% in 2025, according to Digital TV Research.

[ Read: MultiChoice’s Showmax is finally positioned to dominate Africa’s streaming market ]

But Netflix’s hope in Africa rests on their first-mover advantage as an SVOD aggregator. “The key characteristic of Aggregators is that they own the user relationship,” writes Ben Thompson, the renowned technology analyst.

“Critically, the user chooses this relationship because the aggregator offers a superior service.”

That’s it: weather indices may forecast a harsh environment for Netflix’s next half-decade, but they will ultimately win or lose by the quality served to the African viewer.

|

|

|

New telcos in Addis

Ethiopia has been a one-telco country for the longest time, with state-owned Ethiotel enjoying a monopoly. That may soon end; six companies have been shortlisted for a possible license from the Ethiopian Communications Commission. Muyiwa has the brief.

The pandemic gave edtech companies a broad slate to trial remote learning experiments. Did they take full advantage? What did they learn? Daniel spoke with edtech startups around Africa to find out.

Ngozi Okonjo-Iweala made history last week by becoming the first woman and African selected to lead the World Trade Organization. I asked African tech CEOs in the fintech/logistics/e-commerce space of their expectations for her tenure. Here’s what they said.

|

|

|

THE CRYSTAL BALL

“One of the most consequential developments we will see, is the uptake of the Internet of Behaviour (IoB), where data is harvested, computed and analysed to not only track how we behave, but can also guide us into acting and performing in a prescribed manner. Artificial Intelligence (AI) and Machine Learning will go from a supporting role to playing lead, as vast sets of data are generated and the need for rapid interpretation accelerates. Of course, where to store all this data and information, who has access to it – whether people or specific geographic locations etc – also continues to inform the future of cloud and according to Gartner’s 2021 top technology insights, ‘Distributed cloud’

is where it’s headed, growing

more powerful and pervasive over the next few years.”

~ Howard Plaatjes, CEO AYO Technology Solutions

Every week, we ask our readers, stakeholders, and operators in Africa’s tech ecosystem what they think the new normal looks like. We share their thoughts and opinions in this section of The Next Wave. You can share yours with us via email [koromone@bigcabal.com] with ‘The Crystal Ball’ in the subject line.

|

|

|

Cable or no cable

It’s the

33rd of January, and Twitter is bursting with excitement, hashtags flying here and there; one would think that money is being shared. But no, a new movie has just been released on Netflix. Streaming services have amassed such a following that they literally create trends all over the internet.

|

|

|

The journey of providing visual entertainment has been an interesting one, from television channels offered by the government and private corporations to pay-tv platforms and now, movie streaming services, otherwise known as Subscription Video on Demand (SVOD).

Convenience, fear of missing out, and a wide bouquet of content are a few advantages of streaming services over traditional methods.

Netflix set up shop in Africa in 2016, and by 2018, they had gained 400,000 subscribers. Ivory Coast’s Star News Mobile hit 5 million subscribers in 2020.

This was good news for the companies but not Africa’s pay-tv platforms. Their reign as the major provider for entertainment in African seemed to be coming to an end. Multichoice was initially threatened because it seemed Netflix’s entrance into the African market equated to their pay-tv subscribers reducing drastically.

Showmax, Multichoice’s Netflix clone, was its fighting chance against Netflix. On the one hand, Multichoice put in efforts to tailor Showmax to the African market by reducing its data usage, removing location restrictions, and populating it with hyperlocal content to attract African subscribers.

On the other hand, Netflix has focused on partnering with more local creators and infusing more African content on its platform. Also, with about 152,588 subscribers, South Africa is Netflix’s primary market in Africa. The country is about to experience faster and cheaper internet services, meaning that internet penetration problems are on track to being solved.

Coincidentally, the upgrade to cheaper and faster internet service is happening simultaneously. Multichoice’s DStv is planning a price increase for their services.

The war between DStv and Netflix has boiled down to who has a more affordable service across all platforms. While good content will attract customers to both platforms, price will decide who stays or goes.

Get

TechCabal’s reports here

and send us your custom research requests via tcinsights@bigcabal.com.

Written by Michelle Adesina

|

|

|

Thank you for taking the time to read today’s edition of The Next Wave. Remember to stay safe when you are out in public places– protect others by wearing your mask and sanitizing your hands.

Looking for the most comprehensive roundup of technology, life and business stories on the continent? Subscribe to our TC Daily Newsletter and have leading news delivered to your inbox every weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay updated on tech and innovation in Africa.

– Alexander O. Onukwue, Staff Writer, TechCabal

|

|

|

Sign up for The Next Wave

by TechCabal

|

|

|

| |

| |

|

| | | | | |

|  |

|

|

|

|