Going beyond

Last week, Bloomberg reported that Safaricom, Kenya’s biggest telecoms provider, plans to integrate M-Pesa as a payment option on Amazon.

It could make it easier for Amazon customers in Kenya to shop and ship goods using mobile money. But there are two other motives; recovery from 2020 and expansion beyond Africa.

Safaricom’s full year financial results showed a 9.9% year-on-year increase in customers that are active for at least one month; the company now has 31.5 million customers.

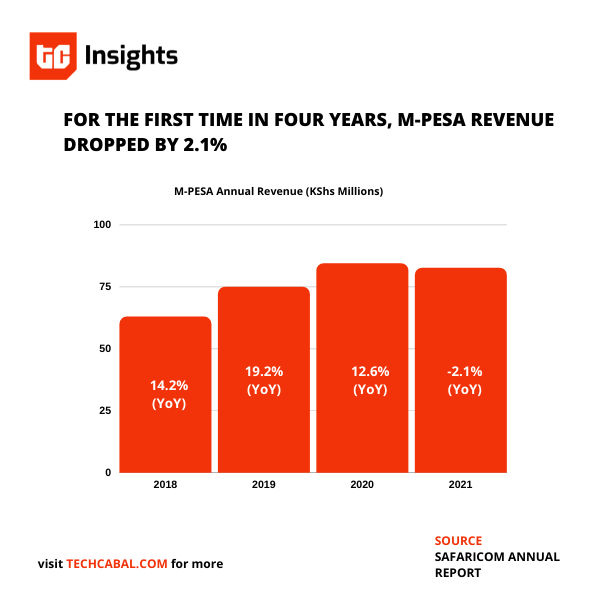

But annual profit declined for the first time in a decade and M-Pesa, which accounts for 33.0% of Safaricom’s revenue, wobbled.

Safaricom’s profit after tax for the 12 months up to March 31, 2021 reduced by 6.8% – from 73.66 billion shillings to 68.67 billion shillings ($642 million).

One month active M-Pesa customers grew 13.6% to 28.31 million but Mpesa revenue declined 2.1% over the same period.

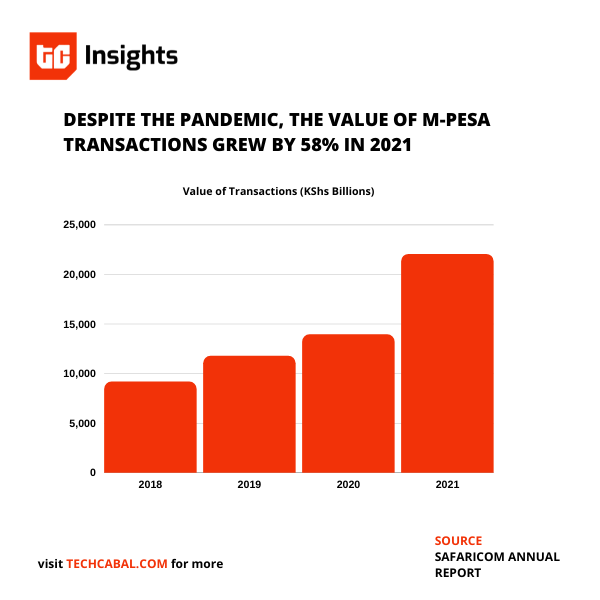

The company resumed charging for transfers in the second half of 2020, causing an upward curve. Total M-Pesa transaction value grew 58.2%. Volume of transactions grew 29.8%.

Olanrewaju Odunowo/TC Insights

Overall, M-Pesa showed resilience in a tough year, proving itself a mainstay of the financial system in Kenya. Number of M-Pesa agents grew 43.1% to 247,869.

To shore up its future, it is only wise that Safaricom plots more use cases to increase M-Pesa’s volume and value. Better still if these cases involve international transactions that increase the product’s global visibility.