Last Friday, at TechCabal’s Future of Commerce conference, I was speaking with two journalism colleagues, and one recalled attending a startup’s anniversary event earlier this year, where he discovered, to his surprise, that the company’s co-founders were absent. This started a conversation about Nigerian tech founders who are operating their companies from outside the country.

Apparently, the proliferation of remote work has not only made it easier for startup employees to work from different parts of a country or the world, it has also made it possible for founders to run their startups from outside the country. But what is the effect of this trend on a growing tech ecosystem?

Earlier in the month, TechCabal published a feature piece documenting how Nigerian tech talents are fleeing the country’s stagnated economy for big Western countries, notably the UK, US and Canada, to build successful lives.

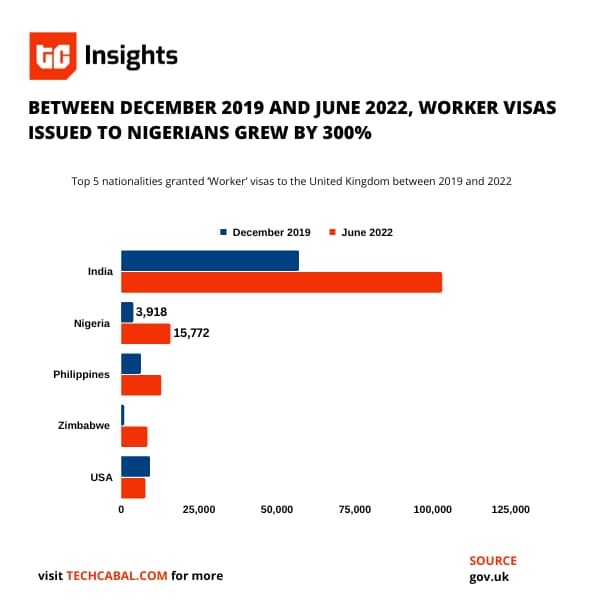

This increase in talent emigration is also captured in a report by the UK Home Office, which estimates that the number of Nigerian nationals who received UK work visas rose to 15,772 as of June 2022, a 303% increase from the 3,918 that had received theirs by December 2019.

While the exodus of skilled workers is not news in Nigeria, an increasing number of founders of Nigerian startups are establishing a base in foreign countries. See it as another form of tech talent exodus.

Capital flight

Tech is increasingly seen as the “new oil” in Nigeria, majorly because tech startups in the country have attracted close to $3 billion in the past three years(excluding this year), per Partech data.

Yet, a chunk of the Nigerian tech ecosystem is domiciled abroad, no thanks to an uncertain regulatory environment.

For example, Stripe-acquired Paystack and unicorn Flutterwave are incorporated in the US state of Delaware. Apart from providing them with stable corporate laws and a favourable tax environment, it makes sense for these Nigerian startups to set up shop in geographical proximity to their investors. When these startups don’t opt for the US, they choose other African countries such as Seychelles and Mauritius which do not only have favourable regulatory climates than Nigeria but are more familiar and predictable to foreign investors. Another reason might be because the island nation of Mauritius is a popular tax haven that has also signed tax treaties with more than a dozen African countries.

Nigeria’s tax environment is not the best in the world. For instance, corporate tax is 30% for companies with a gross turnover of more than ₦100 million, way over the US’s rate of 21%.

Despite Nigeria’s effort in the past few years to pass legislation such as the soon-to-become-law Nigeria Startup Bill and tax reliefs to influence investment flows and reduce capital flight, the country is still losing capital and taxes to foreign countries.

In 2020, out of the $2.86 billion effective corporate tax that American e-commerce company Amazon reported, $1.68 billion was paid as domestic tax. But change is coming.

Last year, G-7 finance ministers agreed to create requirements for large companies to pay more tax in countries where they do business, rather than where they are headquartered. They also proposed instituting a 15% corporate tax minimum worldwide. Amazon had reported an 11.8% effective corporate tax back in 2020, below the proposed 15% rate and almost three times smaller than Nigeria’s rate.

Exodus of revenue

But this exodus of tech founders to low tax hubs is not peculiar to Nigeria.

In India, one of the biggest tech ecosystems in the world—raising $42 billion in 2021—at least 8,000 employees, investors and founders have moved to Dubai through a golden visa that will grant them access to a friendly business environment and tax relief. This 5–10 year visa, which has attracted over 44,000 investors, researchers, entrepreneurs, medical professionals and exceptional students since its 2019 launch, is helping Indian startups cut tax payouts, especially when they are close to liquidity or exit.

But unlike India where founders are also trying to escape a 30% personal income tax on income over ₹15,000,000 ($19,300), Nigeria’s personal income tax of 24% on income above ₦3,200,000 ($7,400) doesn’t look high enough for Nigerian tech founders to make that move. Maybe because there are more pressing reasons to leave, such as fast-rising inflation, poor infrastructure, and rising insecurity.

My discussion with my colleagues made me realise that Nigerian founders, like many other middle-class Nigerians, are seeking “greener pasture” in these foreign countries they are setting up base.

Nigeria, in turn, will continue to lose money from important corporate and personal taxes that are expected to provide the country with the revenue to cover infrastructural deficits in the country, estimated to be as high as $100 billion annually. Without a doubt, the federal government needs to move beyond rent-seeking and glory-taking to actually make the country business-friendly enough for founders to incorporate their startups in the country and live in it.

We’d love to hear from you

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Sultan Quadri

Staff Writer, TechCabal.