This is a guest essay courtesy of Rob Heath.

HAVAÍC’s Rob Heath takes the long view to unpack the perceived downturn in African Venture Capital (VC) funding. Here’s what the data really means and what the future holds for this burgeoning alternative asset class in Africa.

Over the past few months, news of a hard downturn in African venture capitalist (VC) funding, combined with challenging fundraising environments, has cropped up in industry corridors. Given the record-breaking rate of African VC growth in recent years, the news may have left some feeling deflated and concerned for the future.

But this sentiment isn’t based on a complete picture.

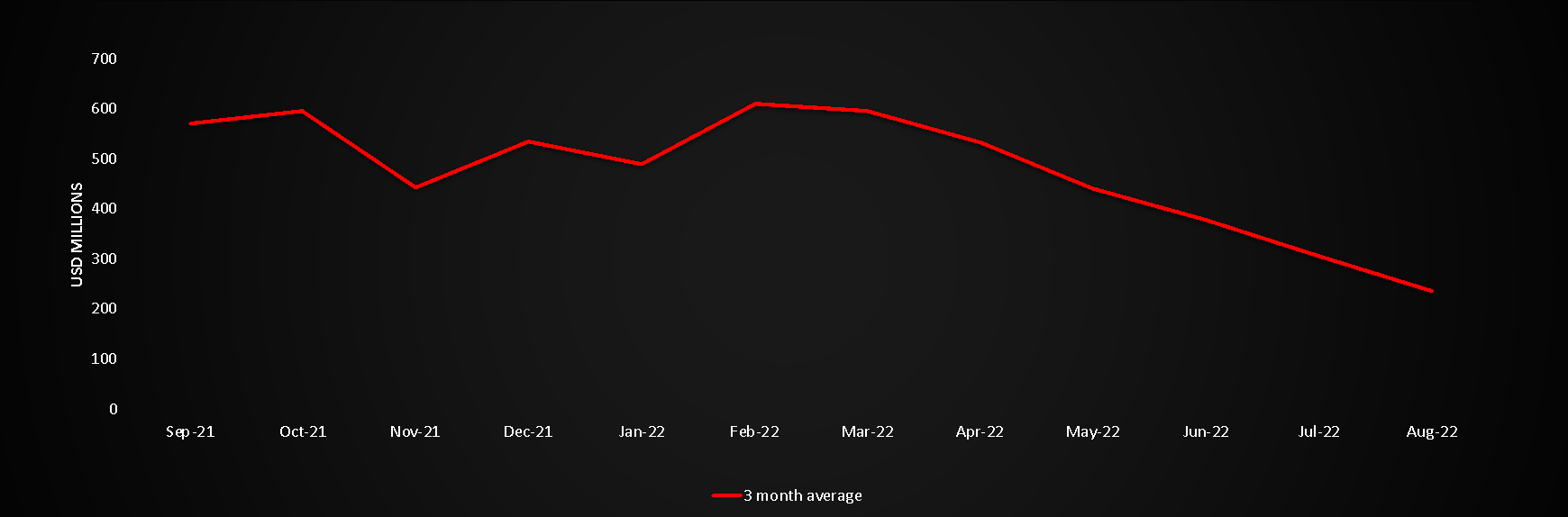

For a period of nine months starting in July 2021, African VC was pulling an average of $600 million into the market each month. Fast forward to April this year and we are seeing a steady, month-on-month decline of 17%, down to $240 million per month in August, as per the graph below.

At first glance, the falling line looks worrisome but let’s consider the full context.

Firstly, the data from the peak period includes a few outliers—large raises like Wave, Flutterwave, OPay, Chipper Cash, Kenyan ecommerce player Wasoko, and Tunisian AI startup InstaDeep—that raised a combined $1.25bn. These large raises account for approximately 20% of the funding during that period.

Secondly, the data supporting claims of a hard downturn is cherry-picked to match recent memory, ignoring what the longer trend tells us. As a result, the current market perception doesn’t account for the complete picture.

In the VC environment, it is all too easy to get swept up in the latest news and ‘hot’ trends, but in the world of professional investing this is the exact opposite of what one should be doing.

Partner Message

Receive money from family and friends living abroad in minutes this holiday season with $end.

Visit send.flutterwave.com and do it now! Go to $end

At HAVAÍC, we take views on opportunities that will play out over several years. Playing the long-term game, like the businesses we analyse, it’s equally important to consider longer term market trends at both the investment and sector level to have a clear sense of what is likely to happen.

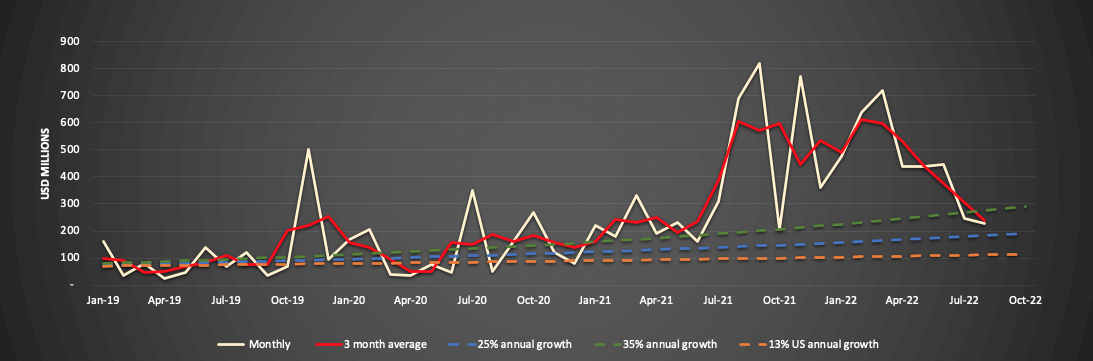

With this in mind, what happens if we expand the view of the above graph, add the preceding three years, and overlay it with rudimentary trend lines?

The first thing that stands out is the funding boom effective from July 2021. The sharp increase is an anomaly underpinned by an oversupply of capital in global markets that also found its way to frontier markets such as Africa. We were acutely aware of this abundance of capital and remained cautious around some of the externally over-inflated valuations that followed as a result.

The capital oversupply problem

Today, recent trends show that the oversupply of capital that swept up the industry for two years is now tempered with rising inflation, interest rates and austere economic policies.

Looking back, the real secondary effect of the excessive funding that flowed into the market is that company valuations increased to unnatural levels and less promising opportunities may have been funded under the pretext of a ‘good price’. Both these situations will make profitable exits for investors harder to come by as companies will struggle to achieve the required multiple returns off a higher base or struggle to keep operating in the absence of funding and/or profitable business models.

The knock-on effect is that markets, in particular younger ones such as African VC, may be tarnished with a ‘poor returns’ brush and negative talk around the water cooler. However, what’s more important than the VC sector’s image are the good companies that may suffer and the knock-on effect on their founders, employees, and the greater communities and economies that they serve.

Kenya’s VC market attracted roughly $400 million in funding last year. Assuming this is for between 10% and 20% of equity in companies, as is typical for earlier stage VC funding rounds, the total implied enterprise value of startups in the market likely equates to roughly $3 billion in 2021.

Partner Message

The Next Wave show is now LIVE!

If you missed the first episode on CNBC Africa, you can catch up here. This episode features Ovo Emorhokpor, founding partner at Beta Ventures, Elizabeth Rossiello, founder & CEO of AZA Finance, Lizanne D’Souza, VP of products at Flutterwave, and Ricardo Schaefer, partner at Target Global.

The Next Wave is brought to you by TechCabal in partnership with Flutterwave. It airs on Wednesdays at 4:30 PM (WAT) on CNBC Africa (DStv Channel 410) Watch the last episode’s replay

Typically, the investors behind this capital would expect to see a 5 to 10-fold return. At the lower end, the numbers are suggesting that the expected value of exit opportunities for these Kenyan startups would be $15 billion for that year.

Currently, the most valuable listed company and the elephant in the Kenyan market is Safaricom (including M-Pesa) with a market capitalisation of $8 billion. The remaining top 10 listed companies by market capitalisation – including seven banks, a brewery, and a tobacco company – are cumulatively valued at less than $6 billion. So, if the top 10 companies in Kenya are worth ‘less’ than the theoretical future values of these startups, who will buy these businesses?

Looking abroad for offshore exits would likely require companies with solutions that transcend local markets and perform on the global or at least the regional stage. While there are many that do, most are solving local problems at best. As a result, it is fair to say that the 2021 numbers from Kenya, and by extension the rest of Africa, were not sustainable.

This, of course, is a simplistic view as there are many other factors that influence valuations and exits. But, as the adage goes, you make your money when you buy (as opposed to sell) and at the very least, this supports our caution in the 2020/21 period.

But what does this mean for African VC?

After separating the anomaly of the past few years from the data, two questions remain:

- What is a sustainable level of VC funding?

- Where are we in relation to the state of VC funding today?

Being cautious of over-extrapolation, we believe the blue and green lines above frame a reasonable and sustainable range of growth trajectories for African VC funding. On the face of things, the lines represent a realistic and business-as-usual scenario; there’s a steady, overall upward trend which is cause for optimism. This of course ignores the snowball effect that often follows on in such a growth environment, as well as incredibly high-performing businesses that simply shoot the lights out. But given the global context, cautious optimism feels appropriate.

Partner Message

Our first-ever Naira virtual card is live!

Set up in 20 seconds or less. You can fund your Paga virtual card via bank transfer, from your Paga wallet, a linked bank account or card, via USSD transfer, or any agent and start enjoying now! Download or update your Paga app to start enjoying yours!

At the lower side of the range, the blue line represents a very comfortable growth rate for African VC. It maintains that the downturn is not a market implosion, but merely a reversion to a trend line that has been steadily increasing at 25% per year for the past 4 years. More importantly, this market correction, whilst appearing less exciting than one may hope, is in fact a nominal 12% to 17% above the trend line experienced in the US VC market over the last 15 years.

Playing the long game, the data paints a positive picture. While it’s important for investors to consider external factors, it is equally important to remember the compounding power of patience when making investments. Equally, whilst cautious optimism with a hint of realism is the name of the long-term investing game, it’s also about finding those outliers, and something that separates ordinary investors from the ones who deliver market-leading returns.

It’s for these reasons that HAVAÍC continues to invest in African-born startups as illustrated by the number of investments we have made this year. Not only does the data show that the growth is just beginning, but with our growing portfolio of African-born, tech businesses that solve real-world problems, all whilst achieving market-leading returns for our investors, the writing of continued success in the sector is on the wall.

Rob Heath is a partner at HAVAÍC. He has worked and travelled in Africa, the USA, and the UK as an executive, business founder, chartered accountant, and advisor. Rob’s operational expertise, wealth of multi-sectoral knowledge, and detailed financial acumen have been instrumental in the growth and success of HAVAÍC and its 17-strong portfolio of early-stage, high-potential companies.

Read: Bayo Adesanya on the power of partnerships and AXA Mansard’s Innovation Exchange Program

Dear reader!

2022 has been a wild ride in the African tech ecosystem, and we have played a critical role in covering the players, the human impact and the business of tech in Africa. We have provided the content, reported the data, asked questions, and organised events to help you understand how tech is changing Africa.

Now it’s time to take stock. Please take a few minutes to share your thoughts on how we did in 2022 and what we should do better in 2023. By filling out this survey, you stand the chance to win a $50 gift card!

Thank you for your time! Click here to tell us how we did in 2022

Sources

https://techcabal.com/2022/03/16/how-much-did-african-startups-raise-in-2021/

All listed funding figures are denominated in USD*

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.