Web version. Original published 12 March 2023

For our French readers…

As I walk through the valley of the shadow of death I take a look at my life and realise there's not much left cause I've been blasting and laughing so long, that even my mama thinks that my mind has gone

— Gangsta’s Paradise by Coolio ft Tupac Shakur

The world of venture has a propensity for the loud and dramatic, and the last six months have been nothing short of drama for technology businesses and for national economies. The sad type of drama.

This week’s newsletter will focus on three hoodoos that each mark a stage in the development of this economic valley of death. We’re talking how leverage crises is strangling food commerce startups. Plus an entry about the warning shot for Africa’s VC ecosystem despite dodging a direct hit from Silicon Valley drama.

Sitting on leverage

Debt financing is one of the rare artefacts of modern economics that is simultaneously attractive and unappealing. Especially today. It doesn’t matter whether you are a full-blown UN-recognised sovereign state or a tiny 10-person startup that just raised $5 million on the eve of the collapse of a long-running tech bubble.

But the leading benefits of credit—no equity dilution and leverage to expand the business, or for governments to stimulate an economy—collapse when the cost of issuing credit loses its lustre. For singular entities, the concern is contained, but for connected systems, a kick from a well-heeled boot can cause one too many dominoes to fall.

Of course, you know this very well. I am simply pointing out that in an environment where risks of national debt crises are elevated, the financial sector will be prudent to prepare to bite the bullet. In a deeply financialised world, financial sector troubles mean that the real economy will have to live through waves of economic hardship as the government and finance wonks attempt to recalibrate the default.

Food, inflation and credit

The most visible manifestation of this chain of crises is in food. Last week, Kenyan punditry went ballistic as the Central Bank of Kenya directed commercial banks to ration USD, following a worsening foreign exchange shortage. Several currency traders and importers say banks have imposed a daily cap on dollar purchases of as little as $5,000. At the same time, years of severe drought have contributed to a rising food import bill. In 2022, Kenya’s food import bill hit a 5-year high, according to data from the Kenya National Bureau of Statistics (KNBS).

Kenya has major debt repayments due next year, in 2025 and 2026, even as public debt sustainability indicators like the debt service costs as a fraction of exports, have deteriorated. To complicate matters, global bond markets have tightened, making it difficult for the country to refinance some of its debt by issuing Eurobonds.

All of this economic mumbo-jumbo is most accurately expressed at food stalls and grocery shops.

As Egypt clearly understands, ahead of the Ramadan fast, the country’s national leadership opened Egypt’s annual Ramadan food drives three months ahead of schedule to help combat rising food prices, courtesy of a shortage in the supply of food and, more importantly, a shortage of the foreign currency needed to release food that has already arrived from Egyptian ports.

As the economic crisis bites, it is strengthening informal retail markets. For example, the Tuesday street market in the densely populated El Talbia neighbourhood, one of Cairo’s poorest, is growing in popularity and attracting new shoppers every week who come from all over the Cairo area, for cheap prices.

In countries that are already far ahead of the valley of death curve, like Argentina, special “food FX rates” are being created to help combat unrelenting inflation. After being cut off from international markets, following its ninth debt default in 2020, Argentina introduced a “soy dollar” scheme, in September 2022 that allowed farmers to export soybeans at a premium rate of 200 pesos to the dollar instead of the official rate of about 150 pesos at the time. The government expected the move to help shore up foreign reserves. Last week, the country revealed plans for a wine currency FX scheme—the “Malbec dollar” exchange rate.

Let’s not talk about Ghana and a (potentially) worse crisis on the horizon for Nigeria.

I’ve walked you through all of this just to say that the economic situation as expressed in FX and debt crises for countries where imported food makes up a huge chunk of how people are fed is not looking bright. And why is this important?

Because we have massively funded food commerce as an alternative to regular e-commerce in the hope that better distribution enabled by smartphone technology will lighten the load for informal retailers. But has it?

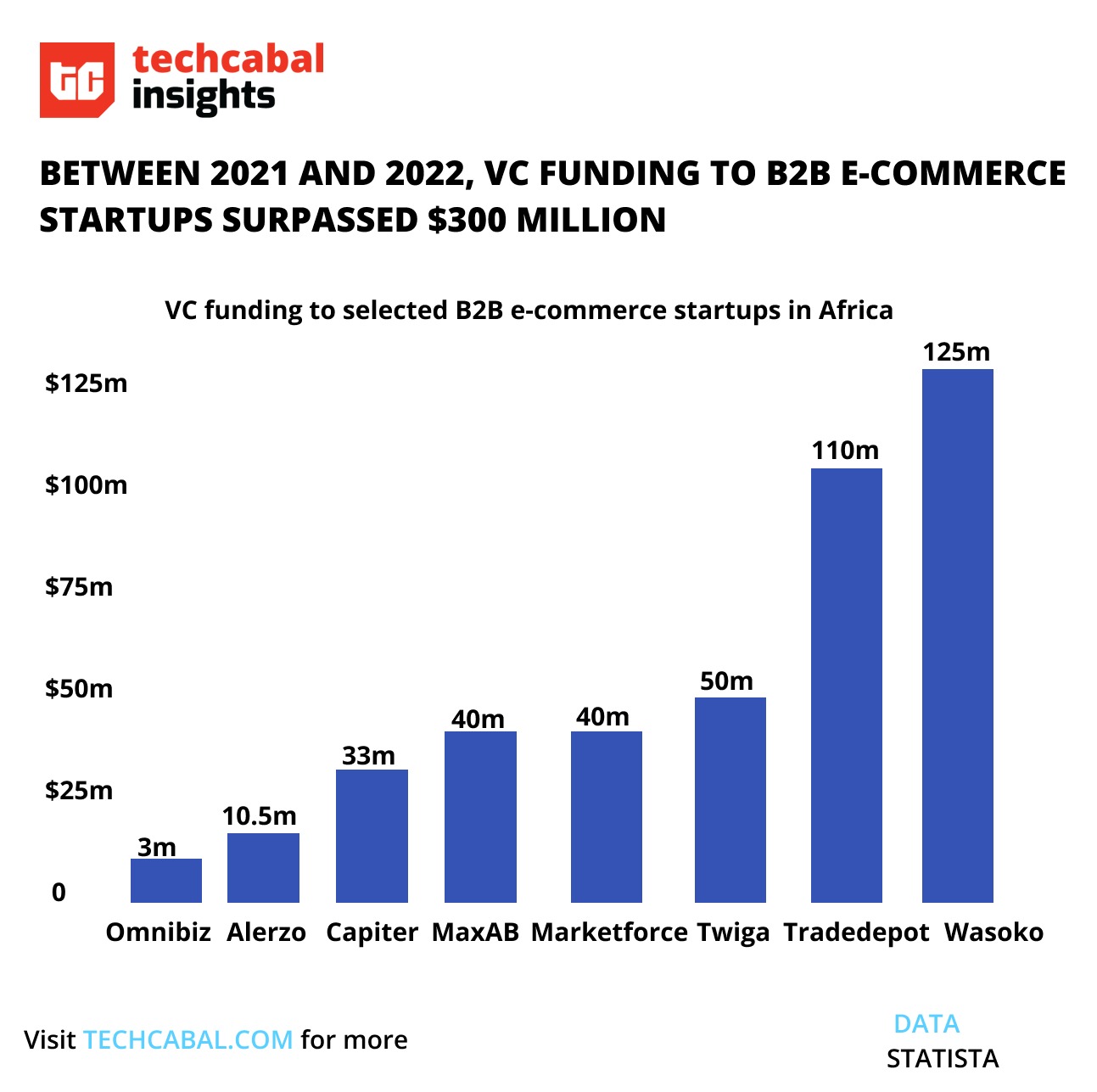

African VCs bet, and the media narrative supports B2B food commerce digitisation as the best place to get a foothold in the continent’s vast and chaotic consumer goods markets.| Chart by Mobolaji Adebayo — TechCabal Insights

I have strong doubts. My doubts stem from my opinion that the current models for VC-backed fast-moving-consumer-goods (FMCG) businesses are solving a problem that does not exist as deeply as it should to justify the VC investment life cycle of 5–7 years. The problem that was sold was discovery and stocking. But if you take a walk around any sufficiently busy neighbourhood, it’s easy to see that if you take the corner shops as a whole, the commonly bought items are well stocked. And people do not mind spending the extra to get what they do not need regularly in bigger shops and marketplaces.

The retail chains that dot Africa were built in decades as opposed to accelerated within five years. The informal ground game is simply still too strong. Copia Global is about the same age as Jumia and only recently began to make the news (which doesn’t mean much) and it is one of the largest and most spread out of the B2B-type retail commerce companies.

What’s more? The razor-thin margins (which remain beyond the control of most non-integrated or single-layer distribution-only companies) are at severe risk from the economic conditions described above. In group chats and on Twitter, I’ve seen it argued that the addition of credit offerings for B2B retail products may staunch the bleeding margins and help retailers stock more units. I would love nothing more than to conduct research into this, but I can agree broadly.

However, the hard limits for this are personal economics and scale. If people are not earning more how will stocking every corner shop with more SKUs translate into more sales? How many shopkeepers can you take the additional risk-burden of financing their businesses while running your FMCG distributorship?

Putting all together

Leverage fuelled by central banks’ easy money has put much of the global economy in this valley of the shadow of death. As the shadows grow darker, even the world of venture capital will be forced to reckon with things it easily dismissed in the past. Failing to do this will be a painful lesson for money managers of the digital innovation tribe.

For FMCG companies this might mean reassessing the entire value chain of FMCGs, especially for food products, to identify how far back they may need to integrate in order to find better margins. It won’t apply to every market, true, but it is a useful tool for evaluating true market opportunities beyond limited distributorships.

There is light at the end of the tunnel. But no telling how far the tunnel will be. VCs who invest in African food will either have to settle for the long run (touch call) or commit to supporting entrepreneurs with grounded research and experimentation on the value and supply chain itself. From port to warehouse, or farm to shop.

I’ll end today’s piece with an honorary mention of SVB.

It is true that the SVB’s tight KYC (and a general inclination to reject African startups) may have saved the bulk of Africa’s startup community from taking a direct hit as the Silicon Valley lender entered America’s banking history records for the wrong reasons. It is also true that Africa’s tech ecosystem may still take indirect hits from this sad event. But the drama brings to mind the mild Mercury bank-fuelled panic of 2022.

The lesson from the two dramas, both separated by a little more than a year, is clear to me. That at least three robust financial centres, not beholden to kleptomaniac national rulers, are inevitable for the continent to find a path towards innovation development. This and the pressing need to somehow unlock African money (a tough call) to support and translate innovation into systemic impact.

It’s a tough call, yes. It is also something we cannot but continue to make.

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Writer, TechCabal.

|

|

|

|

|

18, Nnobi Street, Surulere, Lagos, Nigeria |

View in Map |

| You received this email because you signed up on our website or made purchase from us.If you know longer wish to recieve these emails, please unsubscribe |