This essay is a contribution from DFS Lab.

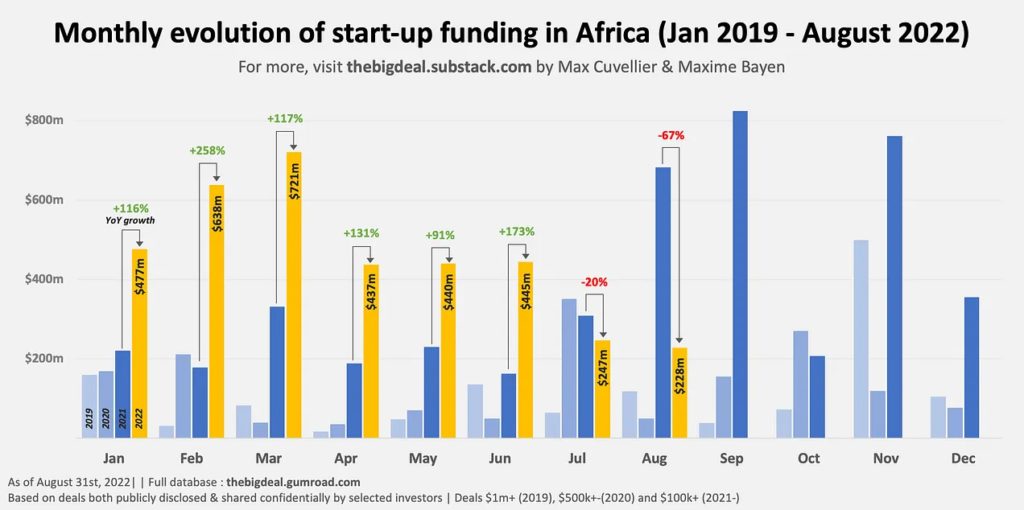

Tides are shifting. As all boats rose in the last handful of years for African VC, the potential for a fall looks readily possible in 2022.

We know that funds that are not Africa or emerging-market-focused have become less enthused about investing on the continent. At the same time, we have seen deterioration in the food, fuel, and fiscal systems in African countries. Even as software eats the world, the world needs to eat. All this is leading to a slowdown in the geometric growth that African VC has seen in the past couple of years.

With the pullback of cheap capital, founders on the continent – like their peers around the world – are now faced with existential questions that have been oft-delayed during the days of uncapped SAFE notes and oversubscribed pre-seed rounds. Questions around unfettered, profitless growth that were previously suppressed by thoughts of twenty-year timelines are suddenly much more visceral. No longer can we afford specious arguments about demographic trends or smartphone revolutions when spending runways end in weeks not years.

We should be clear in our convictions and why we invest.

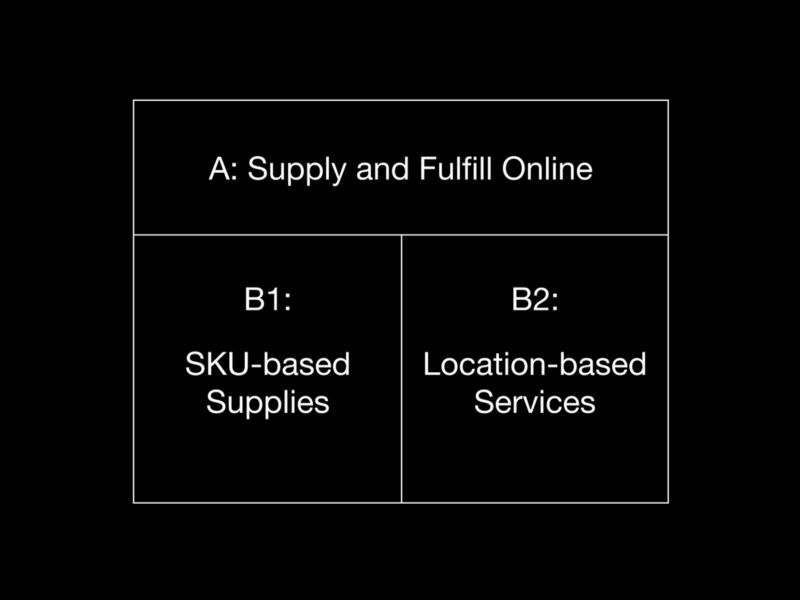

Last October, we wrote about The B-Side of African Tech, an article that outlined what we at DFS Lab perceive as some of the greatest opportunities for African tech. In it, we broke down the tech opportunity under a framework from Wang Huiwen (王慧文), the founder of Meituan Dianping, one of the world’s largest on-demand delivery platforms.

Wang looks at technology platforms and splits approaches between Side A, which favors digital ubiquity, and Side B, which favors physical ubiquity. If you were to apply this chart to most African economies, a snapshot of the addressable market for Side A would be a sliver while Side B would take up the majority. The reason is covered above, that fully digital experiences are either inaccessible, unaffordable, or don’t cover the primary consumption needs for those in the bottom 95%.

The primary focus in ‘B-Side’ is to highlight the interconnectivity and opportunity in atoms-based businesses in Africa – those that source, supply, and sell the goods & services that make up the overwhelming majority of spending1 in African economies. ‘B-Side’ is also at the core of DFS Lab’s ever-evolving thesis.

Since ‘B-Side’ was published, B1 has exploded in terms of funding — almost exclusively for B2B marketplaces that supply FMCG and food. B2B food restocking marketplace Twiga raised $50M in fresh funding. B2B FMCG marketplace TradeDepot raised $110M in equity and debt. Wasoko (formerly Sokowatch) raised $125M. MarketForce raised $40M. And on, and on, and on and on.

B2, through a less mature sector in Africa, has also seen tremendous support across a variety of approaches: TeamApt raised $50M, Brimore raised $25M, The Food Lab raised $4.5M, Tushop raised $3M, Appetito raised $2M, Bumpa integrated with Meta, and YC took notice with bets on Chowdeck, Foodcourt, and Garage.

The discussion around the atoms-based nature of Africa’s digital evolution is also being talked about more often. DFS Lab has also been one of the loudest voices around how digital ubiquity lags physical ubiquity on the continent and as such, startups and investors must adapt.

Still, the hybrid reality of African tech is still less discussed than it should be, usually appearing only when startups run into challenges in the form of logistical nightmares, slow cash reconciliation, and higher-than-expected acquisition costs, among other barriers2. While shifting, our ecosystem continues to be dominated by A-Side visionaries building for B-Side dominated markets.

It makes sense to break down that hybrid reality further. Digital and physical processes can be mixed and matched in several different combinations, so how might a startup effectively approach the “African tech mullet?”

To start, we can borrow a page from science fiction. Hear me out.

Androids and cyborgs are commonplace concepts in science fiction where they are often used interchangeably but are actually quite different.

An android is a robot made to look and act like a human being. On the other hand, a cyborg is a human with robotic or mechanical parts meant to extend their capabilities.

As out of place as this analogy may seem at first, the difference between cyborgs and androids encapsulates the core choice that is made by every startup building a business in Africa’s hybrid marketplace: do you replace informal markets, or do you enhance them?

Here are the two approaches:

- Create solutions that replace informal markets with digital, formalized parts and processes. Build an android.

- Create solutions that enhance informal markets by arming them with digital, formalized parts and processes. Build a cyborg.

To be clear, most businesses evolve between the two approaches and many will have elements of both at different times. However, we do have several examples of each to draw from.

We can start with e-commerce. Many e-commerce startups in Africa have been android approaches inspired by Amazon’s model of two-sided aggregation and direct-to-consumer sales. It’s a model that defines the opportunity as replacing the local market with an online option that is meant to be more convenient, have more options, and is fully digitized.

However, these models have often floundered, partially because they are simply unable to fully replicate the benefits consumers enjoyed from informal markets. Benefits like in-person shopping advice, easy cash payments, and someone to go to for after-sales support all proved to be difficult to replicate at scale. The long-term struggles of platforms like Konga, Jumia. most recently Sky Garden are the result.

Contrast that with more recent entrants in the ecommerce space building cyborg approaches. Bumpa in Nigeria is leaning into conversational commerce and building tools around the informal conversations that make sales happen for Nigeria’s newly digital shoppers. Tushop in Kenya empowers informal community sellers to be the spearhead of its last-mile marketing and fulfillment strategy, leveraging existing social connections to sell.

In fintech, the difference is even more stark.

#AFTSCapeTown2022 – Cape Town Welcomes Thousands of African and Global Fintech Industry Leaders, Stakeholders, Investors and Regulators for the 8th Africa Fintech Summit.

The ‘digital bank for Africa’ has been a golden goose in African tech VC that has seen headlines dominated by android approaches. From the trials and tribulations of digital lenders, Branch and Tala which tried to formalize unsecuritized consumer loans through a fully digital underwriting process, to the recent struggles of Nigeria’s neobank, Kuda, the fintech space is filled with examples of strong teams underestimating the difficulty of replacing offline, cash-based financial behavior with digital-only, online versions.

But where have we seen success in fintech on the continent? It’s cyborg approaches that pair the flexibility of cash with agent networks that serve as conduits to digital transactions. These networks do not replace informal, largely cash-based financial lives – they simply supercharge it with digital optionality when the need arises. Cyborg businesses like TeamApt are proving the point-of-sale agent approach in Nigeria while M-Pesa is a veritable legend in financial inclusion success stories. Tyme Bank, in South Africa, started fully digital and then found much deeper success by leveraging kiosks at in-person retail access points.

We believe in cyborg businesses because we know that informality is only partially programmable. The organic, human elements are often too complex to digitize without losing its benefits.

We refer to programmable informality as the digitally-native portions of solutions that enhance the benefits of existing informal processes within a market.

- First, they aim to create network effects that deepen trust between buyers and sellers in fragmented markets.

- They also improve scalability in atoms-based value chains and come in the form of software that removes friction in the commerce stack from distribution to discovery.

- And perhaps most importantly, programmable informality is strongest when we know to leave informal processes alone, as opaque or “inefficient” as they may seem; to instead build and align around social capital, existing culture, community dynamics, and their often unmeasured benefits.

Cyborg startups will earn a place at the competitive table with how well they operate their offline, non-programmable operations, but they will redefine industries and return venture funds with how far they can push programmable informality forward in Africa.

At DFS Lab, our focus on cyborg startups means that there are several elements beyond the well-known trio of “strong team, big market, moving fast” that we’re focusing on as we partner with founders.

- B1 vs. B2 – we will continue to look for high-potential B1 startups in blue-ocean geographies and specialized verticals, but we also believe it’s a much more crowded field vs B2. However, it’s clear to us that there are sectors outside of FMCG that will likely see the B2B marketplace treatment but with much less competitive pressure— construction, automotive, raw materials, pharmaceuticals, etc.—and DFS Lab is excited to invest in those specialist platforms as they’re built. There’s just simply a lot of opportunity out there.

In B2, we focus on startups that are even more convincingly cyborg-oriented given the hyperlocal nature of these businesses. Critically, we invest in teams who are building approaches to programmable informality that truly disrupt unit economics. This includes emerging strategies like dark fulfillment, conversion franchising, social selling, and more. - Missionaries vs. mercenaries – we believe that the rigor required to build cyborg businesses, including the need to master physical operations alongside software-driven points of leverage means that nuance and authentic experience is critical. More often than not, we find industry missionaries who have shown conviction within a specific sector to hold significant advantages.

This is not to say we believe all founders must be industry experts, but we do believe strong founders must be able to navigate the distinct challenges of specific industries with instincts honed through prior hands-on experience in some form. - Scarcity vs. Abundance – almost all B-Side companies start with aggregating distribution in markets facing scarcity. However, as competition increases and supplies become more readily available, the market of scarcity they started in begins to evolve into a market of relative abundance (e.g. FMCG marketplaces).

We aim to back founders who understand what it takes to navigate that shift from enabling commerce to expanding commerce – required for durable defensibility. This is often in the form of embedded digital services including finance but ultimately will also take the shape of discovery services including advertising and sales support.

For years, we’ve believed that startup profitability in Africa will be found within the friction of its informal markets. But for too long, the ecosystem has tried to brute-force android solutions onto the organic processes that drive our markets.

DFS Lab is here to back the conviction-driven founders who aim to instead build within that nuance with cyborg startups that have the potential to grow into highly-profitable businesses across Africa, and that will show the world what the future of digital commerce looks like.

If you’d like to join us on this journey, please check out dfslab.net and our angel community at sufficient.capital.

Read: How DebtRecuva is using technology to revolutionize debt management and recovery for Nigerians

- DFS Lab. (forthcoming). You gotta break bread to make bread.

- DFS Lab. (forthcoming). Hard limits of retail digitalization.