This essay is a contribution from DFS Lab.

The food value chain is the beating heart of African economies. We see chances to “make bread” investing in companies that help people break bread.

Digitising commerce and creating a modern digital economy in Africa is the DFS Lab’s thing. When we see commerce, be it in digital goods or (yes) physical goods we wanna digitise it!

But what if we told you there was a sector that accounts for more than 50% of all African consumer expenditure? Well it’s true, food and FMCG is the majority of consumer expenditure in many African countries.

Food is huge but food is hard. Let’s start with the first part of that statement. How big is the spend on food and other daily necessities within African economies?

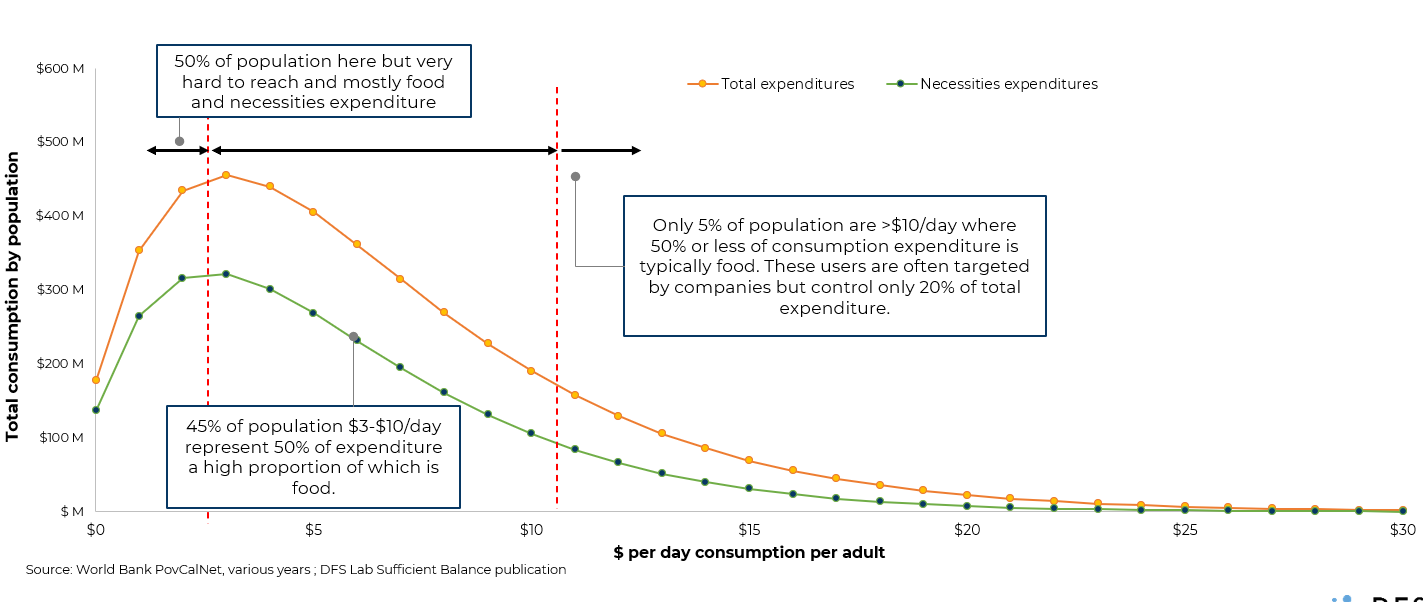

In a previous piece on consumer expenditure patterns in sub-Saharan Africa, we shared the below graph which shows the total amount of all expenditure by the population living at a given level of income (orange line) and the percentage which is spent on food and basic necessities (green line) which is 50-70% for most families!

Figure 1: Height of curve is total expenditure by population at that level of income (number of people at that level times expenditure per person). From: DFS Labs “Fortune at the Middle of the Pyramid.”

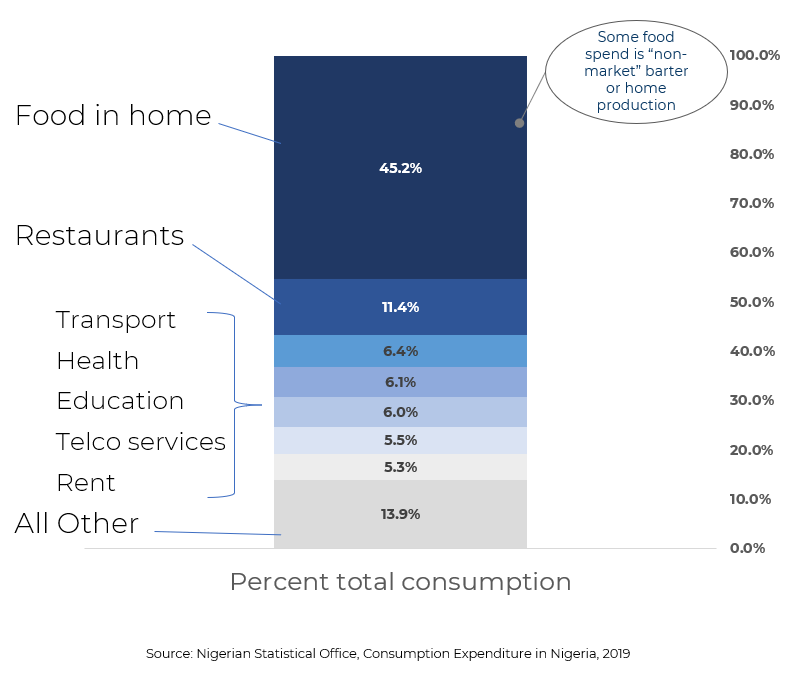

Household survey data confirms food is 57% of consumer expenditure in Nigeria (Figure 2 below) and surprisingly shows restaurants and stalls are over 20% of food and nearly 12% of overall expenditure, beating out transport, health, and education. This informs our investments in restaurant enablement platforms and digital food brands like Orda, 500 Chow, and Ando.

Figure 2: Nigerian consumer spend by category of good or service. Source: Bureau of Statistics, Nigeria, 2019

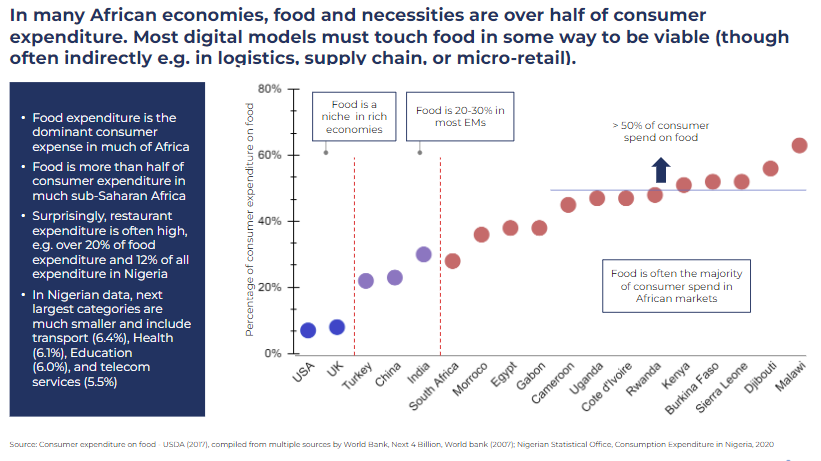

Zooming out globally, we see that in wealthier countries like the UK and the US, food is a relatively small part of the economy—around 8–12% rising to 20–30% for middle income countries; and for the African countries in the dataset, it’s between 40–60% of all household expenditure.

Figure 3:Percentage of consumer expenditure on food by country. Source: Consumer expenditure on food – USDA (2017)

Thus, when looked at through the household consumption lens, food is the most dominant part of the economy in Africa but very much a niche sector in Europe or the US. This difference feeds what we call the “Frontier blindspot”. Very little time, attention, and money in wealthy country entrepreneurial ecosystems focuses on the food value chain so there are fewer models and playbooks for African entrepreneurs to take off the shelf in the food value chain digitisation space than there are in other areas like SaaS, neobanks, or payments processing which are huge in the US and Europe. This distorts the investment landscape and causes many to focus in the wrong place. But this also provides opportunities for actors who know the local reality.

This brings us to the second part of the statement we made above…

Food is hard

Why is the food value chain hard, you ask? Cold chain, spoilage, mice, challenging FMCG relationships, meagre margins, health regulations, fickle consumers, logistics, and the list goes on. So how do we break down this value chain? And where are the big opportunities?

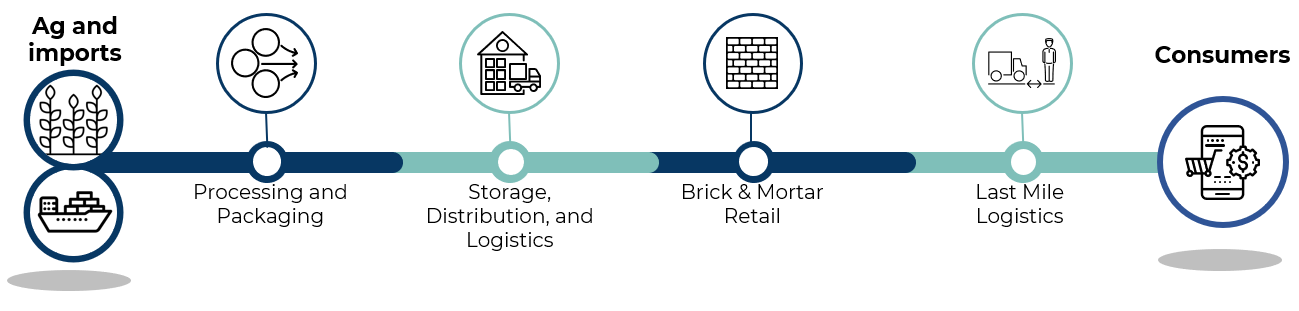

Here is a simple conceptual sketch of the African food (and FMCG) value chain. A surprisingly large portion of food is imported in Africa (over 80% according to the UN, concentrated in 4 countries) so it’s important to recognise that the food supply chain often starts at the dock, not the crop row. Then there is processing and packaging where raw ingredients are converted to more value added ingredients and packaged goods. There is storage, distribution, and logistics. And at the far end, retail, comprising traditional retail (mentioned above), the small but rapidly growing modern retail sector, restaurants and hospitality, as well as new variants like dark stores, ghost kitchens, and DTC delivery that scramble the categories a bit.

Figure 4:Stylistic food value chain.

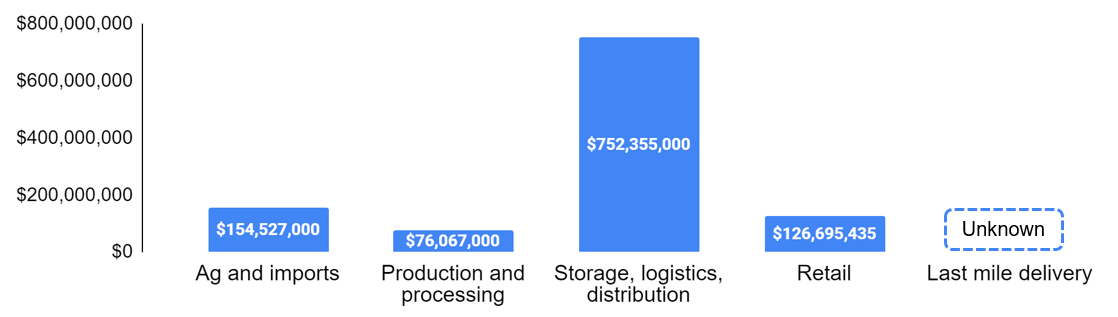

Figure 5:Investment in each layer of the food value chain 2019-2022. Source: Briter Bridges. Last mile logistics was not a separable category.

So what important trends do we see on this landscape? Figure 5 shows venture investing activity which overwhelmingly goes to the storage, logistics and distribution segment, which is in turn mostly driven by major rounds of the B2B restock market leaders. In the past year alone, companies, including Wasoko, MarketForce, Twiga, Maxab, Sabi, and Omnibiz, have raised over $400 million in venture capital and debt financing.

In fact, there is so much activity here that we decided to launch our Retail Digitization Tracker study, which interviews a representative sampling of 2,200 retail store owners and managers across the major urban areas in Nigeria and Kenya. The data charts who is winning in the restock wars as well as the usage of other forms of digital tools and marketplaces by retail locations. We put together a great webinar with four of the market leaders in the restock wars discussing this data and market trends here and PPT here (please contact jake@dfslab.net with inquiries about further analyses of the data).

The restock players are some of the most well placed to corner this value, but they also live in a challenging position as margins are quite low (3–5% generally) and traditional retail owners tend to focus on price and convenience—two things that lead to a race to the bottom of price wars and logistics costs. Meanwhile the space is becoming crowded and competitive.

So yes, food is hard. But we see many points of light.

Between the sector growth and large influxes of investment money there is also a good deal of innovation. In addition to the well funded market leaders, there are lots of smaller players who are tackling different niches, geos, or new models. Examples include Maad who are recreating the restocking model to fit West Africa, Logistify who are building software to make warehousing efficient, Tushop who are creating a group-buy social commerce model in Kenya (a la Pinduoduo in China), Orda creating a SaaS and neo-banking for restaurants, 500Chow with their new take on ghost kitchens, Bumpa who are creating the social commerce operating system, Ando with a growing collection of popular food brands in East Africa, GoBeba who are creating the first dark store model in East Africa, and the list goes on. The market is deepening and running experiments across many models and points on the value chain.

Read: Meet Shekel Mobility, the fintech powering car dealerships in Africa

So we continue to pose the question: where will the food/FMCG/commerce value chain go in the future? The answer has not yet revealed itself to us but as an anchor point, we continue to go back to the beginning of our thought process: food is huge. The food value chain is the grandfather of them all and while it’s not easy, the size of the food sector means there is room for improvement and digitization and new models at all levels of the chain. The book is far from written! And that is why the food and FMCG value chain is a core element of the DFS Lab thesis and will be going forward.

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Writer, TechCabal.