Outside of tracking fundraising metrics, the last $12bn to $15bn invested in African startups through VC should have been a learning experience. So what are we learning about these experiments in African venture capital so far?

Experiments are useful. It forms the core of what we know today as the scientific method. But it was not always so. Initially, early Greek philosophers such as Plato, believed that all knowledge could be obtained through pure reasoning and that there was no need for empiricism, i.e. to go out and measure anything. Over time, however, from Aristotle to Ibn al-Haytham, Roger Bacon to Galileo, and Karl Popper to today, the concept of hypothesizing, testing and recording the results became standard scientific liturgy.

Investing in startups, self-development or modern national economies is not on the same level as lab tests on the latest wonder rock. But it can borrow from the scientific method. Whether for 19th-century whaling or for investing in dynamic fast-changing things like startups. Why is this important?

Repeatable experiments are even more useful

Biology, medical science and physics rely on the important principle of making experiments re-creatable to develop and test innovation, build consumables from it, and scale access. Generally, the more an experiment is re-creatable, especially outside of controlled situations, the more reliable it is.

But the experimental process cannot always be controlled. Nature seems to be its own freak. And there are not many opportunities for this freakishness put on display as much as it is when investing in technology, markets and entrepreneurs bundled together as a startup. So it is not surprising that investing success is not exactly repeatable. But if venture results are exactly not what you want to bet on for being repeatable why should think of them as experiments?

Because when venture investing and most social activities are viewed as learning opportunities, we have a chance to improve survivability and outcomes.

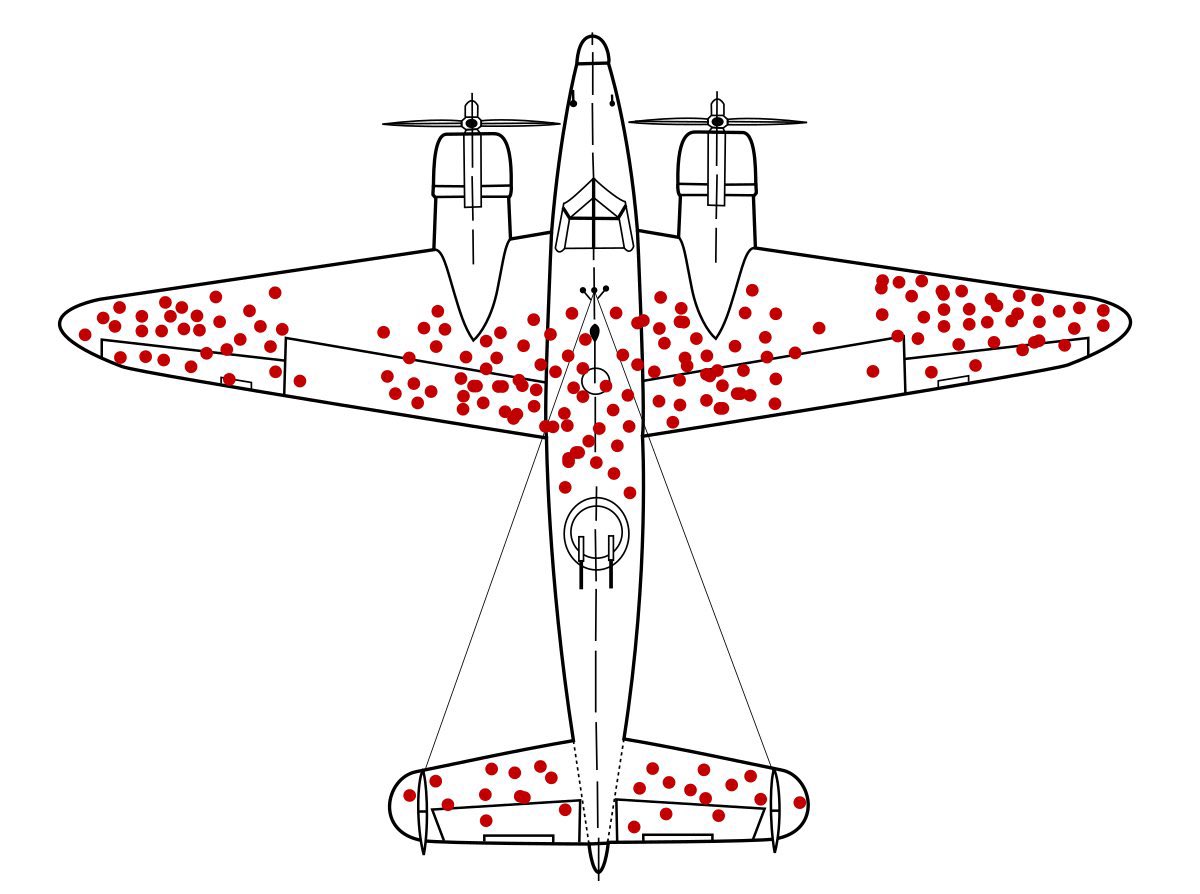

Take this popular illustration of Survivorship Bias for example. We now know that the red dots show the areas where the aircraft is survivable because the warplanes that made it back to their bases were all hit in these areas (quick refresher if you don’t get it). Survivorship bias says more about human weaknesses in interpreting experimental data than it does about the experiments that generate such data. What is important to keep in mind is that we often learn how to best interpret the results of experiments from the process of creating that previously unknown information not just from the result of the experiment.

That we’re able to spot a pattern is important.

When we think about startup investing in emerging markets that do not share many of the characteristics that make alternative investments like venture capital attractive and useful in better-developed markets, we are forcing ourselves to become students. Because we realise that we are conducting randomised uncontrolled trials. Especially when you have between $15 billion and $20 billion invested a decade.

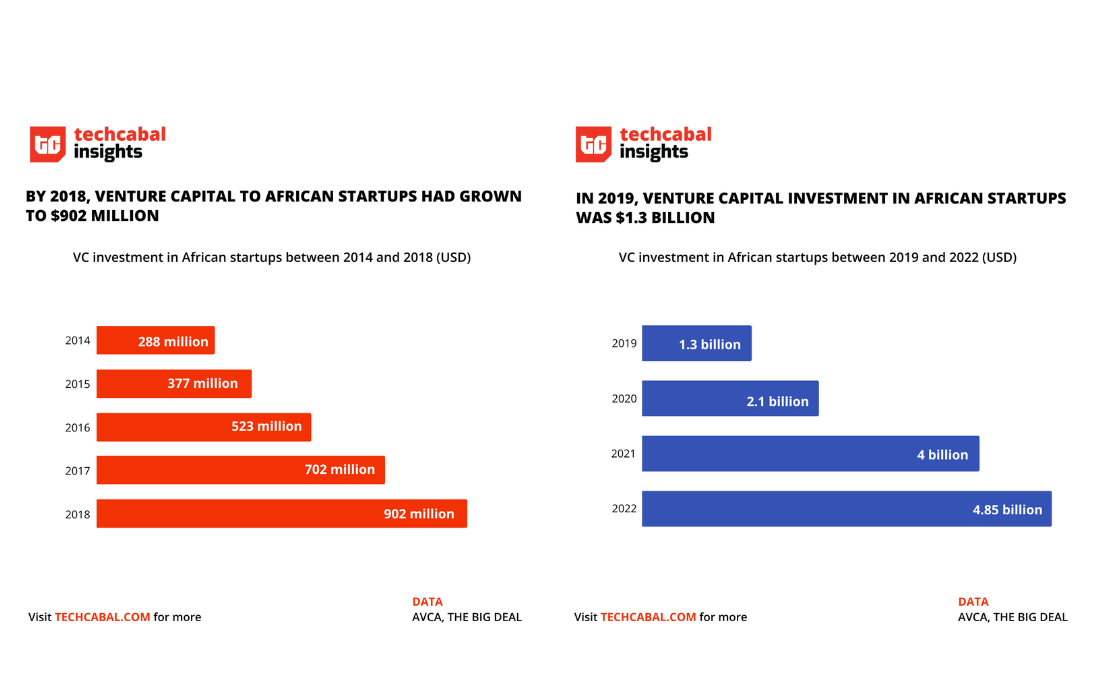

What have we learnt after $15+ billion in investments? | Charts by Ayomide Agbaje, TC Insights

Like the warplanes and young pilots that were sent flying into bullets to unwittingly illustrate survivorship bias for us today. What made the difference? Being able to document this randomised uncontrolled experiment. Because it is uncontrolled and randomised, this type of documentation is not always conventional. Regardless we have to find a way to take the documentation we are given and uncover the lesson the bulletholes teach. In World War 2, the planes that returned were the documentation. It is part of the live experiment.

Do we recognise the last $15 billion of VC investments into African startups for what it is?

Some are obvious. Several of these patterns are already the subject of public and private conversations. A lot more are not. And I wish they were and that these conversations were louder than the hype train we’ve had to endure.

I share a few patterns that may or may not be biased on survivability. Please feel free to add yours on Twitter, LinkedIn or wherever.

- Venture investing in Africa may be unconquered and immature. But it is no longer the wild west. Foreign VC firms are losing their rose-tinted lens as the market is demanding more sophistication than a lot of investors are willing or unable to commit to. Just ask the ashes of investment firms going back to 2015.

- Investors are increasingly willing to consider PE-lite venture capital models (without the leveraged buyouts and other complexities) in how they think about exit expectations. And it’s not just an African thing too.

- Africa needs growth-stage funds, but investors cannot make up their minds about what fund size makes sense as a balance between management fee yield and expectations of profits on the fund. A lot of VCs will be taking (or are already taking) refresher courses on portfolio management. The downside is that they will still need to translate that into Africanese (and for different markets in the continent too).

Do you still think you have a thesis? - We are getting over our obsession with valuation. As Chris Muscarella, Partner at Timon Capital noted in a brief Twitter conversation with Eghosa Omogui, GP at EchoVC Partners (find it here), “the market is figuring out what terminal values at exit and [what] those paths look like. And that will work its way back to valuations and pricing over time.”

- This is the first cycle bottom(?) for many of us, and too many of us are just figuring things out as we go. It’s not a bad thing in and of itself. But it is the ultimate test of maturity. The question before us is, “Leave the linen out to dry,” or “Learn how to dry linen when it is wet, dry and cold without losing our fingers to frostbite.”

To put it plainly. In the venture game, one firm can often not carry an entire ecosystem. Investors can decide to throw the baby with the bathwater. Or they can learn what works best for building viable tech companies in Africa, and sell that to the global venture investment world.

Sponsored:

Rosabon Financial Services to Launch Wealth Management App with Diverse Investment Opportunities

To wrap up—for now

Treating investing as experimentation does not mean being the local madman scientist blowing things off. Nor do you have to be a Tony Stark throwing money on fancy tech in the name of experimentation.

It means treating your activities as an angel investor or venture capitalist as more than an income/management fee opportunity. It means noticing the patterns of bulletholes on the returning aircraft. It means understanding that the best value for what you are doing today will come tomorrow when the cycle changes beat. Why this thinking (especially at early-stage levels) is not more widespread? I don’t know.

I suspect that part of it at least for a lot of local investors, is that investing in startups is personal. There is a lot of personal money being invested in startups by local investors. It is a mission for some of us. And while that is a good thing, it can be a bit of a blinder. Institutional capital when it comes, often carries significant context asymmetry gaps. Or it is the flighty and tourist kind of capital. That is understandable. Most people like to do what’s best for them with their money.

But I fear that the other reason why we do not study (we’ve established what this means I hope) our ventures more, is because we are afraid of what the data might show. This experimentation thinking is not limited to the airplane i.e. the startup. It also includes understanding what all of this startupping and technology is doing to people outside the tech bubble. We don’t pay enough attention to this.

Data is a funny thing that often messes with your mind in non-intuitive ways. Maybe our collective gut sense is to walk in the dark hype instead of turning on the lantern.

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

TechCabal.