First published 3 December, 2023

Experts believe that Nigeria’s telecommunications and tech sector are working at cross purposes. A romance between the sectors could result in a win-win for both sides.

Telecoms is said to be the foundation for the fourth industrial revolution, and a future in the fifth—as the worlds of AI, the Internet of Things (IoT), and big data begin to take centre stage. Research into the use of semiconductors and the integration of voice, audio, video, or data into one single network has today made the industry more viable to scale. As a result, more technology suppliers and service providers are establishing several ventures to contribute to the growing sector while enabling adequate competition to drive down prices of video, voice and data.

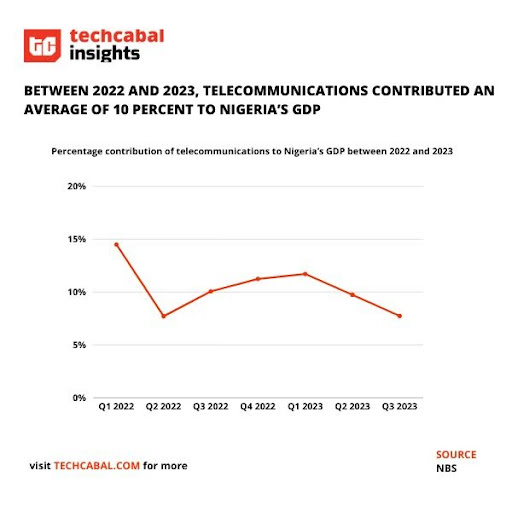

In Nigeria, telecoms has contributed significantly to the Gross Domestic Product (GDP) of the country.

Last year, the executive vice chairman of the Nigerian Communications Commission (NCC), Umar Danbatta, said telecoms contributed over $70 billion to Nigeria’s GDP. “The resultant effect of this is that, today, we now have over 210 million active telephone lines, representing 110% teledensity; and over 150 million internet subscribers as well as 45% broadband penetration which has enabled over 80 million broadband subscriptions,” he said in an address at the 2022 Africa Tech Alliance Forum.

To date, telecoms is still one of the top contributors to Nigeria’s GDP, according to the National Bureau of Statistics’ third quarter 2023 report. The sector has the ability to drive financial inclusion of the country more than 60% if citizens’ phone numbers can be well integrated with banking and payment channels, thereby offering financial services for all.

Article continues after this ad

Worry for the future of the telecoms sector

Many analysts who spoke with me for this edition of Next Wave believe that the telecoms sector risks being abandoned under the current Bola Ahmed Tinubu administration. They believe that a tech-inclined minister of communications, innovation and digital economy, in the person of Bosun Tijani, may pay more attention to startups over legacy tech companies, like telcos.

An expert who confided in me told me that a minister who understands the importance of telecoms and tech would be more successful in deepening Nigeria’s communication sector as a whole. “The last minister, Isa Pantami, was more concerned about the National Identification Number (NIN) and telcos. This current one is interested in tech startups,” the source, a famed journalist, told me.

Pantami is recognised for his reforms in creating a digital identity for most Nigerians, which was initially criticised because of the cumbersome process involved. Many Nigerians had to queue for hours on end just to link their NINs to their subscriber identification modules (SIM). Apart from the clamour from Nigerians who thought the NIN-SIM exercise was needless, leader of the terrorist group Boko Haram, Abubakar Shekau, threatened the ex-minister for the move.

But the linking of NINs to SIMs has today turned out to serve as an infrastructure in verifying the identity of Nigerians.

Tijani, in October 2023, revealed a blueprint that will enable Nigeria to thrive in the digital age through digital technology and innovation. The blueprint stands on five pillars which are: knowledge; policy; infrastructure, innovation, entrepreneurship and capital (IEC); and trade. Knowledge will be concerned with the growth of talent, research and digital literacy while policy will help to encourage investment, research and intellectual property. Infrastructure will focus on broadband penetration, the development of communication satellites, and spectrum management. Innovation, entrepreneurship and capital will concern itself with the growth and sustainability of startups, while trade will be bullish on positioning Nigeria as a top technology centre to the world.

Despite these glowing moves, Tijani has ignored the telecom industry’s recent struggles. For instance, 9Mobile, the fourth-largest operator in the market, has continued to shrink in market size since 2014, when the company had 20.2 million mobile subscribers. Currently, it has lost over 7 million subscribers between 2014 and 2023 and is slowly losing its status as the network of choice. The latest NBS telecoms data shows that 9Mobile had the lowest share of internet subscribers in Q1 2023. 9Mobile had 4.2 million internet subscribers while MTN had the largest share with 67 million. Recently, news spread that 9Mobile may be up for acquisition. If that eventually comes to fruition, it shrinks the sector further. MTN Nigeria and Airtel Africa have also not had it better. Both telcos have suffered declining profits, related to macroeconomic challenges. Yet, the minister is yet to speak on these matters.

In May 2023, active broadband subscriptions dropped from 96,169,176 to 86,993,472 in August 2023, while broadband penetration also dropped to 45.57% in August 2023 from 48.28% in May 2023, heightening worries by the Association of Licensed Telecoms Operators of Nigeria (ALTON) on the growth of the sector. Still, the minister is yet to resolve right-of-way fees that operators face—a move that can deepen broadband infrastructure. So far, only seven states in Nigeria are implementing reduced right-of-way fees. There is a need for Tijani to pay attention to some of these issues and urgently hold meetings with the rest of the 29 states if he is ever going to achieve his infrastructure blueprint of 95,000 kilometres of fibre optic cables in the country.

Article continues after this ad

Can a possible tech-telco romance solve the problem?

The minister would need to engage both the telecommunications sector and technology sector to make sure no one is left behind. A marriage of both technology and telecoms can solve the financial inclusion problem which is currently at 64%.

Former OPay CEO, Olu Akanmu, believes that the recent Central Bank’s directive to block bank accounts without a Bank Verification Number (BVN) and National Identification Number (NIN) would improve the future of financial inclusion which both telcos and fintech are working hard to drive. “With 103 million Nigerians with NIN today, there should no longer be an excuse for accounts not to have a tied digital identity,” he argued on LinkedIn. Akanmu believes that linking bank accounts to NIN would set the stage for more Nigerian adults to have bank accounts. If this can be achieved, cheaper smartphones can be introduced to crash down the prices of phones, thereby doubling the number of smartphones which currently range between 25 and 40 million. This move will enable banks and fintech to bank more Nigerians through mobile money and banking applications. This is a bigger pie for both sectors.

Joseph Olaoluwa,

Senior Reporter, TechCabal.

Feel free to email joseph.olaoluwa[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

Partner Content:

2023 has been a wild ride for everyone. If you’re a founder, please share your thoughts on the outlook of tech in Africa. Click here to start.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.