First published 28 January, 2024

We reached the max tolerance for innovation theatre. What comes next?

Entrepreneurs, investors, an uncritical media, and government are guilty of what Steve Blank, the Stanford University professor of entrepreneurship, calls “innovation theatre”—a body of initiatives we do and promote to signal that innovation is happening, but which doesn’t translate to significant business value or economic impact.

Innovation theatre is pretty easy to spot, but in good times, most people are content to live and let live. When things take a bad turn, though, theatrics tend to disappear in a huff. It’s why people are losing faith in things like acceleratorships, and why more venture capital investors are struggling with an identity crisis and narrative collapse.

Innovation theatrics are not unique to Africa, and these days, it is common to call it out. What is replacing it, though, is a cynical defeatism that is no better, if not simply worse.

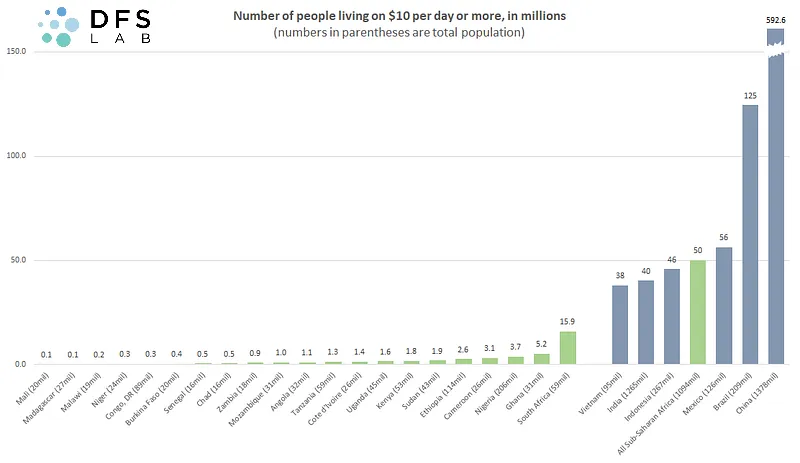

The chart below is popular in Nigerian tech circles. It is from a 2020 article by Jake Kendall, one of our friends at DFSLab, and it became popular in 2022 after Stears used the chart in an article and more recently in 2023. It’s a brilliant read and a good addition to resources for framing your thinking and approach to African markets as an investor or a founder.

But I have always been bewildered by the viral conversations that it sparked on social media. The key lesson for most seemed to be, “Africans are poor. Don’t waste your time”, and similar statements.

For me, the key takeaway of the chart (and the entire piece) is simply that we’ve reached a maximum tolerance level for efficiency and sustaining innovations that rode the mobile/smartphone boom in Africa.

Kendall’s article did a great job of sketching the broad contours for consumer business modelling. But if an entrepreneur building a consumer product looks at it and decides to go build something on a B2B model instead, it tells me two things: (1) Technology is only marginally relevant to what she was working on. (2) The type of innovation being proposed is simply an attempt to profit from naked arbitrage in supply chains by offering what the late Clay Christensen called, “efficiency innovation” or “sustaining” innovation.

This is not to say that one cannot build a good business on top of that economic model—it is possible. However, I believe it’s a mistake to let just that outline the definitive shape of your vision for consumer markets if you are a founder or an investor. Why? Because you may just be confusing the naturally limited market of innovation that improves a product, for the more intensive creation process of innovation that creates new markets. And I’ll be frank. “Market creating innovation” is a hard thing. That is why the examples are few and far between.

Innovation that creates markets

What was the purchasing power of Africans when mobile telephony first took off on the continent? I’m still looking for the answer, but if I were a betting man, I’d wager it was significantly lower than the figures from the 2011–2015 PovCal data upon which (most of) the earlier mentioned chart is based.

The arguments of today about low purchasing power are strangely similar to the arguments of then. In the 1990s Africa was a poor continent, and the time did not look right for mass-market telephony. The difference, though, was not just the new cellular technology operating over the GSM standard. There was also institutional reform in telecoms governance at the political level. And, most importantly, what made it all workable was the new type of distribution, pricing and services that met latent demand.

Kendall and the DFSLab team are quite right when they say that the fortune is probably at the middle of the pyramid where people earn between $4 to $8. Taking 2022 quarterly results from MTN Group, Africa’s largest telecommunications company, average revenue per user (ARPU) across its 17 African markets has a mean value of $3.5 in pure dollar terms, i.e. not adjusted for purchasing power parity. MTN and its peers certainly did not start their business targeting a mean ARPU of $3.5 across Africa. It was certainly much lower when the company started.

So, simply targeting the same ARPU to make your business economics work or investment thesis work in the long term appears to be flawed to me, regardless of whether it’s consumer or business-to-business. The major exception to this is if what you are creating and advocating for is an efficiency or a sustaining innovation. And if it is, we should be clear about it upfront.

Every innovation that created or unlocked new markets has been epochal or at least a part of a mega-trend or supercycle. We seem to have forgotten this. Supercycles are, in the world of commodity trading, a decade(s)-long period of extraordinary prices where old price expectations are reset and new anchors weighed. For our purposes, a supercycle is the early buildup of long-term consumer trends and economic activity where the key metric is not current consumption patterns, but the sum of the direction of progress over time.

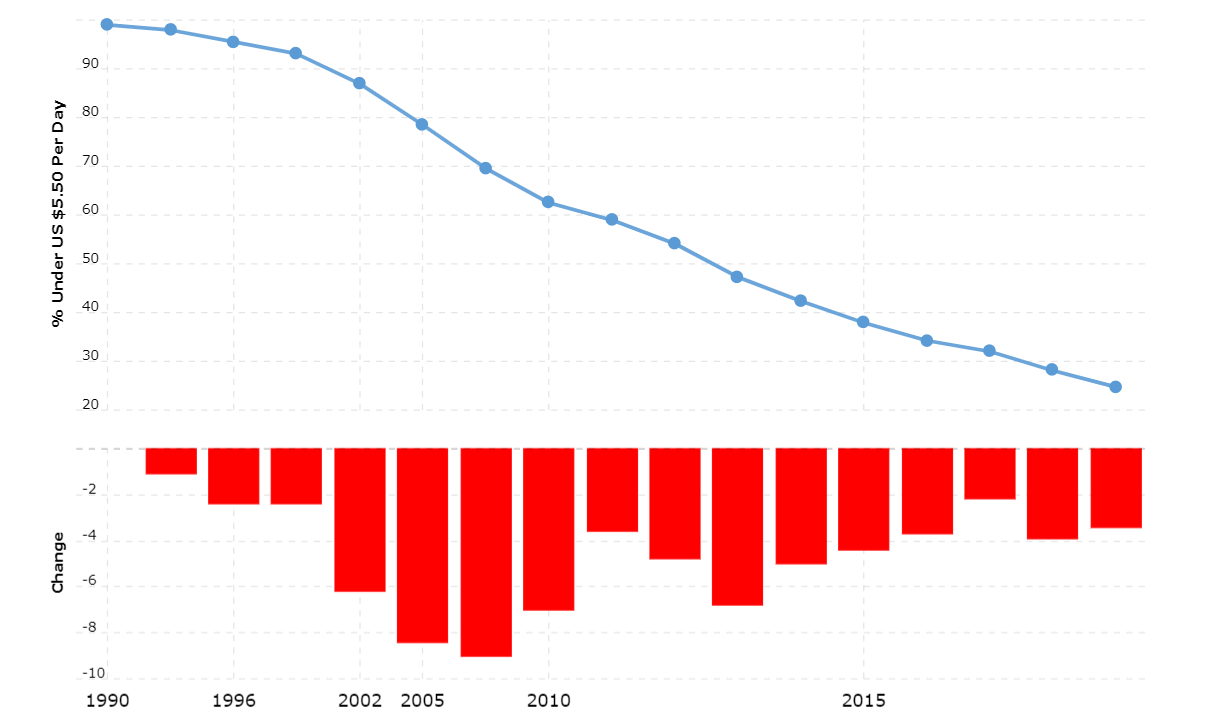

China Poverty Rate 1990-2024 | Via Macrotrends | Data: WorldBank

When cars were becoming a more accepted part of life in America in 1906, most people were not buying cars. Telephones shortened distances and made relationships (business and otherwise) easier to manage, but, in the 1990s, most Africans did not own telephones. And when the Chinese were migrating en masse to cities in search of work opportunities after the Deng reforms, most of them couldn’t afford microwave ovens, despite the fact that China was producing them for the export market by the 1990s—until Galanz switched from selling duck feathers to making cheaper versions for the domestic market. China’s poverty rate in 1990 was 99%.

Innovation, especially market-creating innovation, can still happen when the economic indicators are not in the best state. There just needs to be a clear macro groundswell that is being tapped. Product or service solutions that become successful in creating markets and value ecosystems become market-defining players as economic fortunes turn.

In Africa today, there’s probably a space for entrepreneurs and investors who will take time to tune out the noise and zero in on finding a new way of doing business a.k.a launching a solution that creates markets rather than seeking profit from the current market setup. It is, after all, how Africa “leapfrogged” telephone landlines.

Abraham Augustine,

Senior Reporter, TechCabal.

Thank you for reading this far. Feel free to email abraham[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

Programming note: Joseph Olaoluwa in Lagos, and Kenn Abuya in Nairobi have been sharing fresh perspectives on the Next Wave newsletter since Q3 2023. They will now man the fort with my full support.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.