First Published 17 March, 2024

Policy and regulation have the potential to significantly impact the operations and growth of innovative businesses, if applied wrongly. Technological advancements do not have to suffer clampdowns at every turn; a collaborative approach to regulation is what’s needed.

The biggest crackdowns on tech by most African governments tend to happen with fintech. In 2021, the Central Bank of Nigeria (CBN) secured a court order to freeze the bank accounts of stock trading platforms Risevest, Bamboo, Trove and Chaka for six months. According to the CBN, the firms were responsible for the weakness of the nation’s currency and operated without licences. One of the affected companies lost users and deposits after the announcement.

Next Wave continues after this ad.

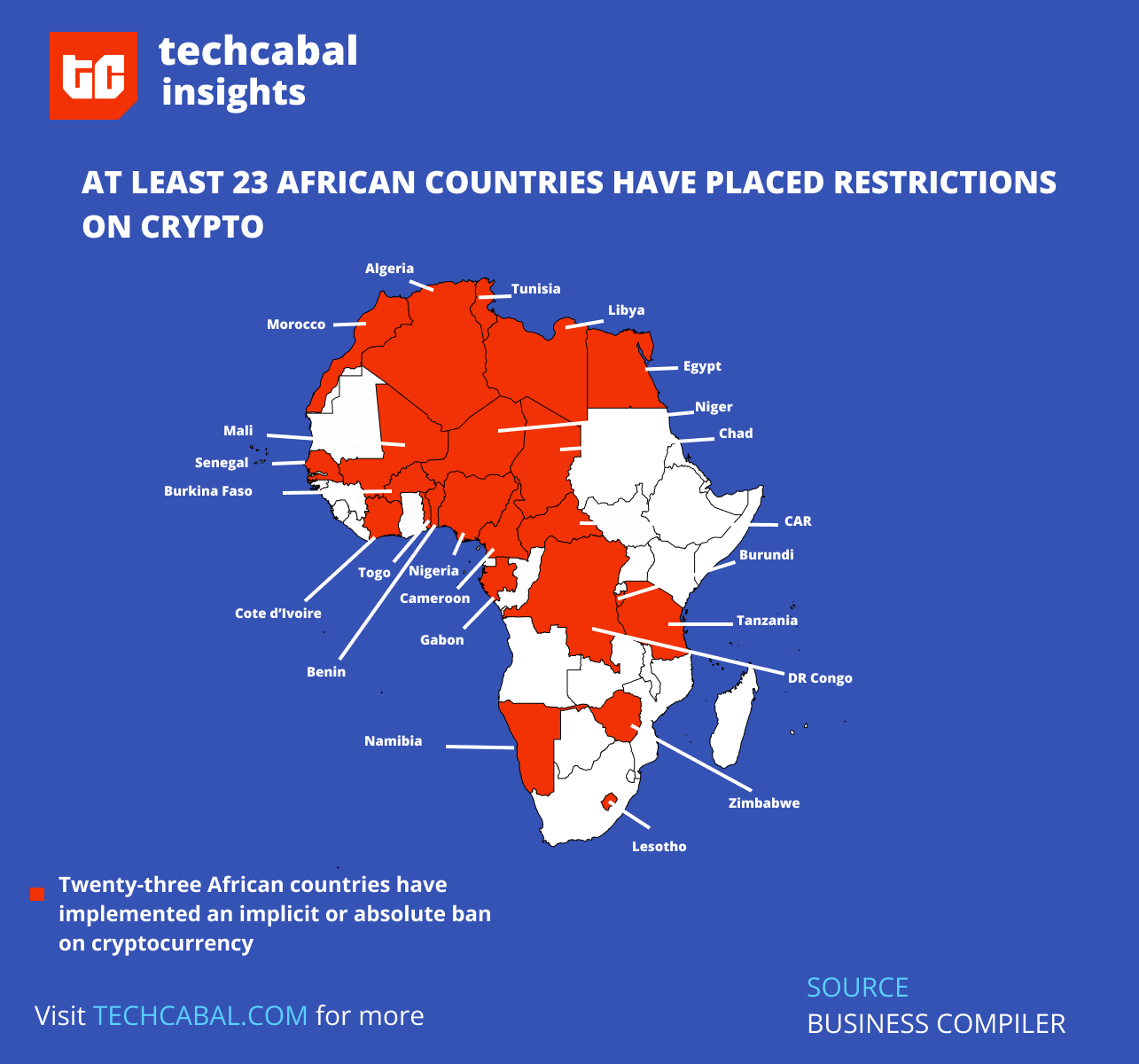

In 2022, Flutterwave had its assets frozen in Kenya, which put a pause to its expansion plans and dragged its reputation in the mud. Last year, the Central Bank of Kenya cautioned residents against dealing with individuals and entities offering payment services without licence. It warned that these services were unregulated and a criminal offence. As at 2023, a total of 23 African countries have banned or restricted the use of cryptocurrencies within their economies, stifling innovation in the area.

Number of African countries that placed restrictions on crypto. Chart by Stephen Agwaibor, TC Insights

The major problem governments face when it comes to regulating tech is striking the right balance between safeguarding their economy from the consequences of badly-adopted technology and resisting the urge to over-regulate or under-regulate.

Before fintech can be effectively regulated, we need to understand its peculiarities, as distinct from those of traditional finance institutions. Regulators must understand the infrastructure fintechs operate on. One CEO said that more knowledge sharing between fintechs and governments could be the difference between profiling, poor regulation and high licensing fees.

Partner Content:

Read: All the things we like about the TECNO Spark 20 Pro Plus

here.

In a fintech company, innovation moves faster than regulations can keep up with, so it’s important that regulation is flexible enough to accommodate, or even preempt, these changes.

A middle-ground approach to regulation can be considered instead of issuing outright bans or restrictions that hurt the fintech sector.

Regulators in Africa could have applied the sandbox model to cryptocurrencies, before taking any big decisions. Sandboxes can serve as a safe space to test innovative services, products and models without immediately applying all the normal regulatory consequences of engaging in the activity in question. This is particularly helpful for regulators who are seeking to understand new technologies and collaborate with industry players to establish rules for managing services, products, and business models that stem from emerging technologies. It also helps to lower the costs and regulatory barriers for testing disruptive, innovative technologies without negatively affecting consumers.

Next Wave continues after this ad.

Another model governments should consider is the segregation model. This model regulates fintech companies by introducing a specific regulator for the industry, instead of using central banks who are more attuned to traditional banking methods. The United Kingdom has a body, the Financial Conduct Authority (FCA), which regulates all financial markets and services in the UK. There is also a Payment System Regulator (PSR) that regulates payments in the UK.

All that said, the future of fintech regulation is collaboration and information sharing. Regulators must remember that they have a duty to create an enabling environment for innovation to thrive.

Joseph Olaoluwa

Senior Reporter, TechCabal

Thank you for reading this far. Feel free to email joseph.olaoluwa[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.