You must have heard how it was said, “no matter what happens at your startup, never run out of money” but is this really true?

I was doing my version of The Hard Thing About Hard Things at a technology career workshop where I spoke on entrepreneurship to a group of young people who were considering venturing out as an option.

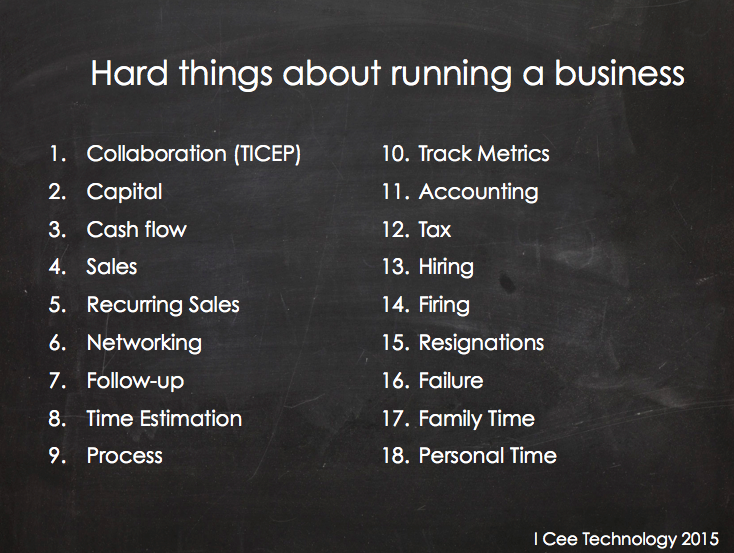

Amongst other ideas I had a list of 18 hard things from my experience running a technology business. I talked extensively on the need to focus on commercializing inventions and then the three C’s for startups- collaboration, capital, and cash-flow. I ended this stage with an oft-repeated maxim:

no matter what you do, never run out of money…

At the moment those words escaped my lips, I had an epiphany of sorts that even then I could have missed, if someone in the audience hadn’t asked an iterative question.

…and what happens if you run out money?

I would have said something along the lines of — simple, your startup dies! But today my answer was going to be different, there was a truth at the back of my mind, asking to be reconsidered.

Almost every successful company I know ran out of money as a startup.

Hold on one sec! Let’s test this.

Apple [✔], AirBnB [✔], Konga [✔], Intuit [✔], Tesla [✔], Hotels.ng [✔],

Loudcloud [✔], PFS [✔], Basecamp [✔], …

The results are interesting but it does not overrule the evidence of other startups that failed because of negative cash flow. So why did these startups avoid certain death?

The best word I found for it is ‘resourcefulness’. These startups were able to tap into their team’s strengths, inventiveness, and create enough value to keep the lights on till the tide turned.

AirBnB’s story is very well told.

When they ran out of credit cards, the founders needed a new idea. It was during the McCain-Obama election, so they decided to turn boxes of Cheerios and Captain Crunch into political schwag. CEO Brian Chesky recalls contacting a print shop who shipped him 1,000 cardboard boxes labeled “Obama O’s” and “Captain McCain.” Chesky and his co-founders were able to land themselves on a national TV show and they sold out of the cereal, which offset some of the cost of their apartment rental company, Airbnb. Later, Chesky and his co-founders pitched Paul Graham to get into his Silicon Valley startup accelerator program, Y Combinator. Chesky says the interview didn’t go well, but in a last-ditch effort, his co-founder whipped out a box of Obama O’s and handed it to Graham.

Graham asked, “What’s this?

Loudcloud ran out of money, but successfully pivoted to Opsware and later sold to HP for over $1B, a story that is well documented in The Hard Thing About Hard Things.

One metric that must not be lost in all this hypothesis is the question of time. These companies ran out of money when they were still at the early stage — in the case of larger organizations the results could be markedly different.

Startups can run out money for factors beyond their control but the one’s that survive have teams that are competent and well constituted, with the right attitude to rally together and provide solutions to difficult cash flow situations.

When Hotels.ng ran out of money, Mark had to rally together the resourceful people on his startup team and together they solved their cash flow issues.

At the core of a startup it’s important to have people with right risk appetite because one day despite your best efforts you might just run out of money and then be rest assured that your team will find a way to turn things around for good.