I received hope from a podcast.

Yes, from a podcast. To be specific; from episode 4 of the weekly Crudcast podcast hosted by Ezra Olubi and Uzo Olisemeka, which I was listening to on the 2nd of November by 9.05pm.

I remember the exact time because I wasn’t supposed to be working (it was my wife’s birthday). But she was working, because she had a presentation at work the next morning. The kids had long gone to bed. With some time to kill, I lazily browsed Radar and decided to listen to the latest episode of Crudcast.

About 16 minutes into the show, Ezra casually mentioned that he was leaving his current job at Delivery Science to join PayStack (a payment startup) as the CTO and as he described what he will be tackling – something happened. It was right at that moment that I felt the first glimmer of hope that there’s a way out of the omnishambles, which is the Nigeria payment system. ‘At last!’ I said to myself; ‘at last, someone is coming to rescue us’.

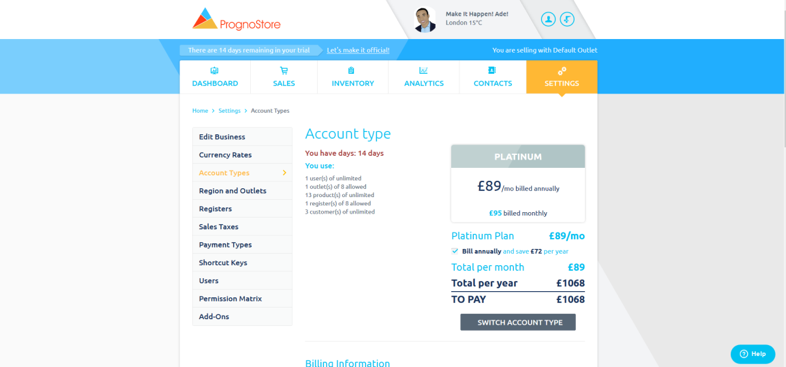

To understand why I feel the current state of payments is so horrid, you first need to understand that I’m approaching this from the perspective of a SaaS founder. And you have to understand my SaaS company – PrognoStore.

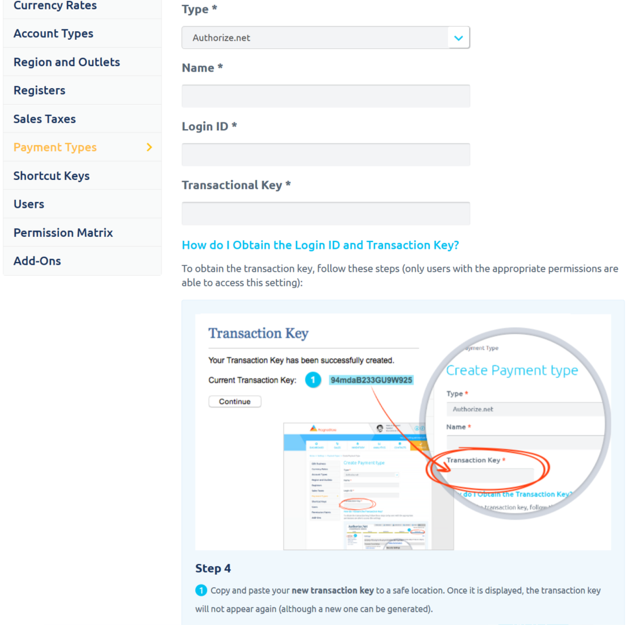

The key goal for PrognoStore is that we are making it easy for Shop owners to run their stores. This means for every development decision we take, the objective is to simplify the chain of activities involved in running a store. We have a great advantage because we’ve advised countless clients over the years in the UK and in Nigeria, which means we have insights into things like integrating accounting systems (Xero) and payment portals (Authorize.Net), because it makes the lives of our clients easier.

However our challenge comes from the fact that we serve clients based in 3 countries.

Take for instance, our accounting system add-on. All customers (irrespective of locations) get exactly the same benefit from our integration to Xero. But for payments, this is not the case. Where payments are concerned, it’s more efficient to be a PrognoStore customer in the UK or Australia, than in Nigeria. It’s also easier for us (PrognoStore) to receive monthly subscription payments from our customers in the UK and Australia compared to Nigeria. Why is it this way? It’s simply because there’s no good alternative in Nigeria, that can provide what Authorize.Net does for us and our clients in other parts of the world.

Two ways to describe these differences are as follows:

- A shop owner using PrognoStore in the UK and Australia, can use Authorise.Net to take card payment from their customers. The key advantage that it offers over similar Nigerian platforms is that it sends the transactions results directly to PrognoStore. This advantage accrues directly to the PrognoStore store owner (a key distinction).

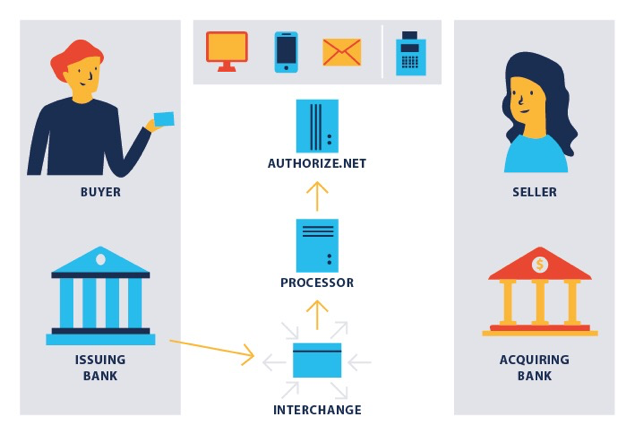

Below is an illustration of how this works.

This is simply what they need to do in PrognoStore once they have merchant accounts.

Our customers in the UK and Australia don’t need to mess around with reconciling the sales from their stores with their bank account. It’s all linked and done automatically. And they don’t have to jump through hoops of fire to get this activated.

- We (PrognoStore) as a SaaS business can charge direct debits from our customer accounts in the UK using Authorize.Net

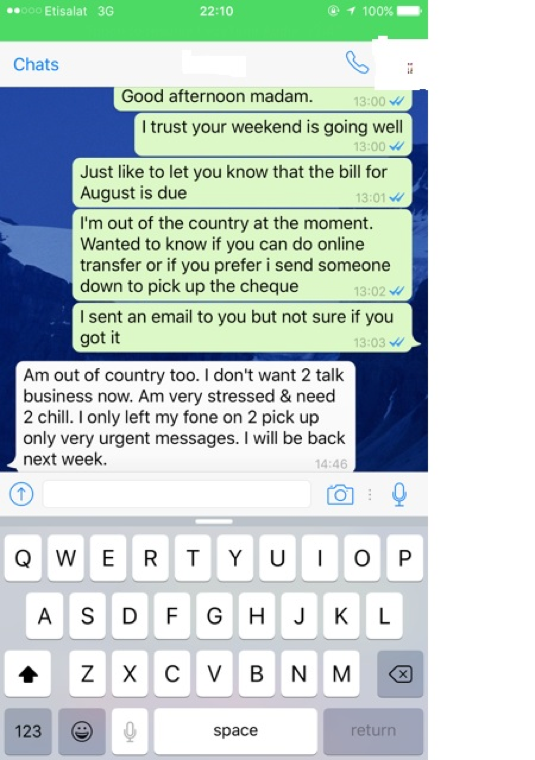

We don’t have to send reminders to people to pay or chase people for payments. The ‘chase people for payments’ scenario is like the horror movie no child should watch, because it leaves them scarred for life. You think I’m exaggerating? See this screenshot my co-founder received.

Mofe, who runs the Nigerian office said to me: “this is my reality, I have staff to pay, I have rent to pay, an office to run but customers don’t feel obliged to pay even though they’re using the service”. How terrible.

There is just too much fragmentation, and so many points of friction in the current process. And it’s not just startups that are feeling the pain. This is why each time of the month when you have to make payments for recurring bills (think DSTV), it’s frustrating, because you really have no intention of cancelling.

If we solve payments, these 3 things will happen in the Nigerian startup ecosystem;

- Startups will be able to survive. By nature and particularly at the beginning, startups are fragile and won’t survive if they can’t get paid for provided services.

- It increases the pace of innovation to solve real problems. Most v1 products aren’t great. However, a startup/company that survives has the chance to iterate and make better products. Think v.50!

- If more startups survive, they will provide employment and contribute to GDP. Startups of course hire top talents (who they pay top wages), pay taxes and hopefully do some good to society. Only if they survive.

In summary, there’s no happy ending (yet). I’m still just a founder of a SaaS company who knows payment is broken. The only difference now is that I now have hope. For all the startups out there (like PayStack), working hard to crack the payment space, on behalf of other founders, we wish you all the best. And to the established players who are working on resolving this conundrum (like Africabeta: Fixing Payments, Naija Edition), it can’t come soon enough. We need you to save us.

Ade Olabode is an adviser to small business owners. He’s the co-founder & CEO of PrognoStore. He is a chartered accountant and has previously worked at Deloitte, Credit Suisse and co-founded HGE Capital.