Cynthia sells skincare products online. When customers make orders via Instagram, her e-commerce store or her website, she gets the item from her inventory and finds a logistics company to deliver the item to the customer. Sometimes she makes the deliveries herself. Cynthia can’t keep a large inventory like say, Shoprite, because she doesn’t have the luxury of space. Combine her delivery costs, and the lack of space, and you have a brutal case of stagnation. She often has to turn down orders.

Femi, an online electronics retailer, also has the same challenge. He can’t stock bigger items like double door refrigerators because the warehousing and logistics challenges are more than he can solve, along with managing all the other challenges of a small business. Cynthia and Femi would have less things to worry about if they had access to a Fulfilment Company. This kind of company lets them store any amount of inventory they want, improve operational efficiency, scale up and potentially widen their profit margins.

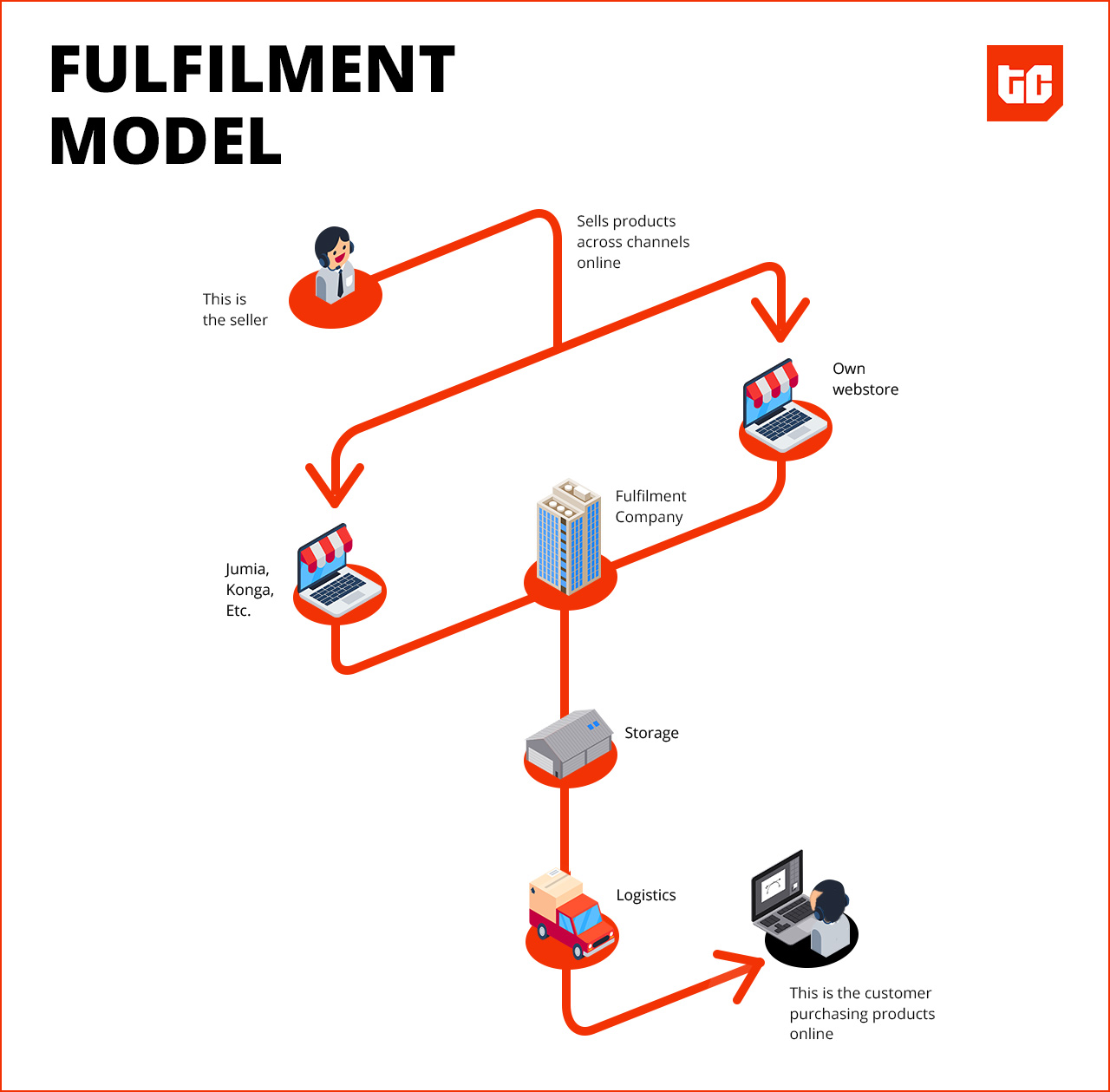

Value organogram of the fulfillment model explained

Inventory storage at scale is expensive and the seasonal nature of retail means there will be underutilized space which compounds operational costs. The current models make it difficult for small retailers to scale and many African e-commerce companies such as Konga and Payporte have ditched warehousing all together and/or outsourced logistics to third-party firms. Several online retailers have also stopped offering payment-on-delivery. On the consumer side, demand has tilted toward faster and free shipping, piling the pressure on shippers and retailers to store and fulfill orders closer to their destination.

Fulfilment companies are a new kind of business offering solutions that fit perfectly at the intersection of retail storage and logistics, which are typically the most costly parts of the online retail value chain. This model allows warehousing services to be scaled back to low levels during off-peak periods, or up to meet peak demand at a fraction of the combined cost. In addition, the fulfillment company also handles delivery to the customer on behalf of the retailer.

South African company, ACT Logistics, said in a 2017 post, “In countries like Nigeria, where the majority of goods sold online are imported, e-commerce companies run the risk of dead inventory and financial loss; [If they can’t] manage their inventory carefully and monitor and predict sales.” The fulfilment company model cuts down on these costs and improves supply chain efficiency by bundling retail storage and logistics as a service. It also allows small retailers to scale or increase their baseline operations.

Use case globally

In foreign markets, startups like Flexe (US) and Anchanto (Asia) are built on the same fulfillment model. These companies provide storage to the retailer as they may need it and also handle customer service, quality check and packaging, and delivery to the customer, bundling warehousing and logistics services as one package.

Amazon has been using this model through its “Fulfilled By Amazon (FBA)” program which it launched in 2006, even though the concept is only just catching up. In FBA’s words, “You send your products to Amazon fulfillment centers, and we pick, pack, and ship them and provide customer service.” UPS has also launched a similar service called Ware2Go, which allows retailers ship and store items closer to their customers without having to commit to long term contracts with warehouses. This way, warehouses can fill unused space and utilize excess fulfillment capacity, and retailers get shorter turnaround times on logistics.

Existing implementations in Africa

While some ecommerce startups have included a version of the fulfillment model in their business setup, the closest thing to independent fulfillment companies one can find in Africa are Kenya-based Africa Logistics Properties (ALP) and South Africa-based ACT Logistics. They both aren’t digital-first businesses. ALP, founded in 2016, specialises in the development, acquisition and management of grade-A warehousing. It currently has two projects in Nairobi: a 49-acre site in western Nairobi and a 22-acre logistics and distribution park 25km north of the Central Business District. ACT Logistics combines local and international logistics services as well as warehousing services.

There is also a logistics startup in Nigeria currently testing out the model with the hopes that it will be able to figure out how to make a business case for it. According to the founder of this startup, variable commodities such as fashion items are much more complex and costly to fulfil than non-variable commodities like high-end cosmetics and skin care products. But there is huge potential there, he said.

With its plethora of infrastructural challenges and hostile business environments, Africa stands to gain a lot from hybridized business models such as fulfillment. The ripple effects of a new crop of entrepreneurs and businesses utilizing the fulfillment model holds incredible potential for online retail in Africa. With 50% of the continent expected to have access to the internet by 2025, according to a McKinsey report, online shopping could account for up to $75 billion, or ten per cent of retail sales. Better optimized supply chains and innovative business models, like fulfillment, have a role to play in that future.