According to KPMG, the 2020/21 top 10 business risks in Nigeria are as follows: regulatory; financial and monetary policy; foreign exchange volatility; cybersecurity; political; technology infrastructure; customer attrition; talent shortage/attrition; business continuity; governance.

Regulatory risk has become more prominent over time. It was number 7 in KPMG’s 2016 survey and rose to third place in 2018. It’s now the number one risk for private businesses, especially those in financial services.

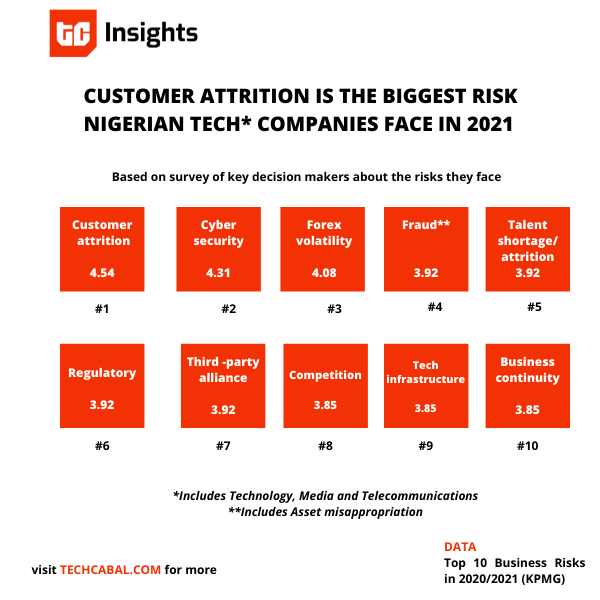

The risk hierarchy for tech, media and telecommunications companies differs from the general top 10 above. Customer attrition, cybersecurity and foreign exchange volatility risks are most pressing, while regulatory risk was ranked sixth.

Olanrewaju Odunowo/TC Insights

Let’s clarify that 77% of the companies in this survey have an annual turnover of over $15 million and 48% have over 300 employees. Most Nigerian startups are not at these marks, hence the risk maps may not be an exact match.

However, these signposts give a sense of what VC’s can expect when they plan to invest with the goal of reaping multimillion-dollar returns.

AfricArena projects that VC funding in Africa will be between $2.25 billion and $2.8 billion this year. That will be a huge recovery from the $1.43 million in 2020 (according to Partech).

Nigeria raised $307 million of that 2020 total. Will the country retain its perch at the top with a putatively riskier environment?

With Egypt on the march, perhaps not. But Yoneyama, who has a fresh $18 million to invest across Africa, says “market potential and tenacity of Nigerian founders surpass such risks, so we’ll keep investing.”

And why not? Twitter bans and hostile governments come and go but the optimism for enterprise in Africa will only increase. Exits are not yet commonplace but one or two ventures have paid dividend. But those rewards are for those who, looking at the risks above, still dive in.