August 8, 2021

The Next Wave provides a futuristic analysis of BizTech in Africa. This newsletter goes out every Sunday at 3 PM (WAT) and is written by TechCabal’s managing editor, Koromone, with support from TC Insights.

Hey everyone, it’s Koromone. I have always been fascinated by the pace at which fintech companies move and grow in Nigeria. In the beginning, when these companies arrive on the scene, everyone is curious about who they are, their products and services, how they plan to penetrate or take over an existing market, and how they plan to grow into a profitable business.

So far, we’ve been pretty impressed with some of the success stories coming out of Nigeria’s fintech industry. Apart from Flutterwave and Paystack’s meteoric rise to influence and superstardom, TeamApt and PiggyVest are equally blazing trails within our ecosystem. These companies are not just talking the talk, they are also expending much energy into growing their business, expanding into new markets, and putting some money back into the pockets of their investors and backers.

While payment gateways and savings apps are helping Nigerians get more comfortable with using their local cards and trusting technology to manage and grow their wealth, digital banks are playing their part to improve banking services in the country.

Traditional Nigerian banks have come under fire lately due to increased transaction failures, buggy mobile banking apps, and poor customer service. Last month, Daniel published an eye-opening report on the mass exodus that occurred in GTB midway through the year. With GTB losing a good portion of its IT and infrastructure team, it was no wonder that their customers complained about delayed outgoing bank transfers and incoming payments.

So who can deliver us out of the hands of conventional banks who seem to have lost their way and forgotten that they exist to serve their customers, not frustrate them?

Let’s find out.

Partner message

The Flutterwave Mobile app, the app that turns any smartphone into a mobile POS is now redefining commerce. The Flutterwave Mobile App makes it super convenient for anyone to take their business with them anywhere, anytime. Learn how you can take your business anywhere, anytime here.

In the beginning was ALAT bank…

For the sake of those who are relatively new to the digital banking scene, Kuda Bank isn’t the first digital bank to promise Nigerians seamless and secure banking services.

In 2017, Wema Bank – yes, the 76-year-old financial behemoth that banked our parents and grandparents – launched ALAT as Nigeria’s ‘first fully digital bank’ (their words, not ours). Fully digital meaning their customers didn’t need to go into a banking hall to set up their ALAT account and request a debit card. ALAT’s arrival into Nigeria’s financial scene was unprecedented and largely unexpected but we whipped out our phones, downloaded their app, and immersed ourselves in their digital banking experience. But in the three years following their launch, ALAT has gone quiet and their Instagram comments section is littered with complaints and accusations from frustrated and embittered customers.

Fast forward to the second half of 2019 – a year before the deadly outbreak of the coronavirus forced the world to literally shut down — Kuda Bank (formerly KUDImoney) — arrived on the scene to save the day. But beyond colorful debit cards and personable brand ambassadors, what’s interesting about Kuda Bank is their funding trajectory.

Kuda Bank’s funding trajectory

In 2019, Kuda announced a $1.6 million pre-seed raise led by Haresh Aswani and a number of angel investors.

A year later, in December, Kuda raised $10 million – the biggest ‘seed’ round to ever come out of Africa. At this point, the digital bank had 300,000 customers and had processed over $500 million transactions per month.

Pretty impressive numbers.

In March of this year, Kuda raised $25 million in a Series A round led by Valar Ventures with Target Global in participation as well.

Are you still tracking with me?

Last week, the fintech startup announced a Series B raise to the tune of $55 million at a valuation of $500 million. If you do the math, Kuda’s new raise happened just a little over four months after their $25 million Series A. The aspirational digital bank has also grown from 300,000 customers to 1.4 million customers and now offers overdraft allowances to pre-qualified and vetted Kuda Bank users.

Kuda Bank is clearly a vision-driven company. According to Babs Ogundeyi, co-founder and CEO of the fintech startup, Kuda is on a mission to ‘bank every African on the planet.’ This is a pretty ambitious mission and the question on my mind is: Are they also ambitious about acquiring underbanked and unbanked customers in Nigeria and on the continent? It’s one thing to serve people who are well-versed in digital banking technology; but it’s a completely different story when it comes to building baking services for under-represented customers.

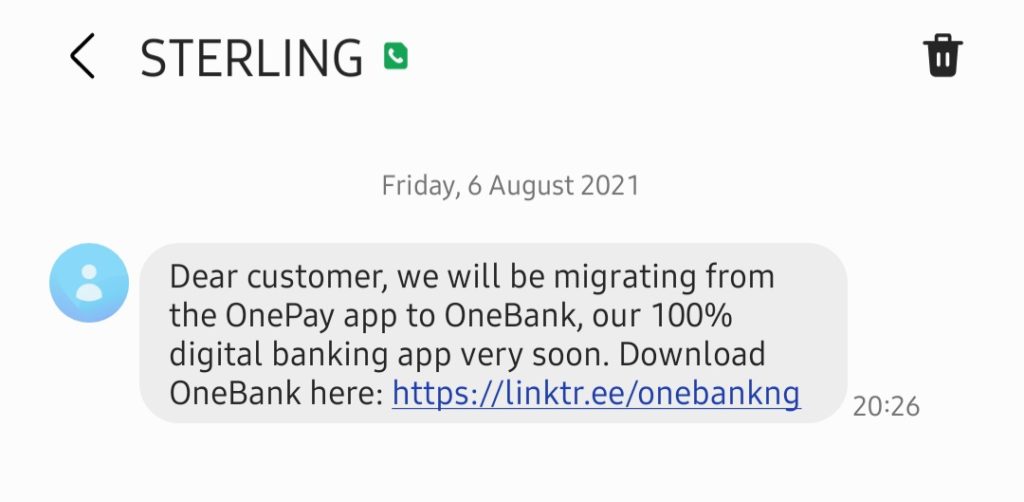

Keeping the future in mind, we have to acknowledge the new players in our digital banking ecosystem. Sparkle, Fundall and Eyeowo have caught our attention. Fairmoney recently announced plans to evolve into a digital bank, and Sterling Bank has plans to migrate their customers from the OnePay to OneBank – it’s ‘100% digital banking app.’

Partner message

Do you have questions about building a Global Company? Curious about the expansion and future of Bitcoin in Africa? Join Ventures Platform Foundation and ARM as they host Ray Youssef, CEO of Paxful, at the #LabsbyArm Startup Insights event on August 13th. Register at bit.ly/labs3si

Digital First

Customer acquisition and retention can be a tough task for banks. An Oracle survey found that customer satisfaction with traditional banks decreases as the customer relationship progresses across the financial lifecycle.

Across the world, digital banks like Nubank and Chime are doing a great job of easing the onboarding process for new customers.

By adding more products across the customer life cycle such as small-and-medium enterprise banking, investments and financial management and credit facilities, customer satisfaction is beginning to increase.

A study by PwC reveals that customers who experience pain points with their traditional bank are most open to digital banking. In Singapore, 77% of customers with three or more pain points were more interested in opening a digital bank account.

In Africa and other parts of the world, to open an account with a traditional bank typically requires a lot of paperwork. It’s the first impression that deters many.

Digital banks on the other hand, allow customers to open accounts easily, in a process known as digital on-boarding, with facial recognition and document uploading technology. This allows them to verify the identities of potential customers without their physical presence.

This approach has warmed the likes of Kuda and Piggyvest into the hearts of many. With a young population, and a large percentage of mobile internet users, the market exists.

But it’s not all rosy. Many account holders of digital banks still hold on to their accounts at traditional banks for fear. There’s an assurance that walking into a banking hall brings when problems arise.

But one can’t bet against the growth potential of digital banks. Backed by venture capital, a young and digitally-savvy customer base; their future looks bright.

Without physical locations or branches, digital banks must invest in excellent customer service to keep their customers happy. This will go a long way in making them a primary option for young Africans.

Technology may bridge the gap but money remains a legal tender that depends on trust.

Have a great week

Thank you for reading the Next Wave. Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

– Koromone Koroye, managing editor, TechCabal