September 12th, 2021.

The Next Wave provides a futuristic analysis of BizTech and innovation in Africa. Subscribe here to get it directly in your inbox on Sundays at 3 PM (WAT).

The big picture: Francophone Africa’s first unicorn

In case you missed it: Wave became Francophone Africa’s first unicorn after a $200 million funding announcement went live last week. But Wave isn’t a new kid on the block who just stumbled on an investment pot of gold; the unicorn startup has been serving the Senegalese mobile money market since 2017.

Wave’s recently acquired unicorn status is a big win for Francophone Africa, and for the continent. We are still recovering from OPay’s recent $400 million raise and MNT-Halan’s $120 million funding announcement a few days ago.

Africa’s technology ecosystem is bursting at the seams and global investors seem eager to provide the capital needed to help high-impact startups reach their full potential; even amidst government regulations, questionable central bank policies, internet bans, and economic instability.

With just three months left till 2021 closes out, how likely are we to see Africa produce a few more unicorns? The continent is heating up and with household names like Sequoia Capital, Stripe and SoftBank backing African startups, this could be the decade of African unicorns, and possibly, even a dragon (dragons are more established companies that are committed to long-term success).

In this edition of Next Wave, we’ll take a closer look at Wave’s position in the mobile money market and their road to success.

Partner Message

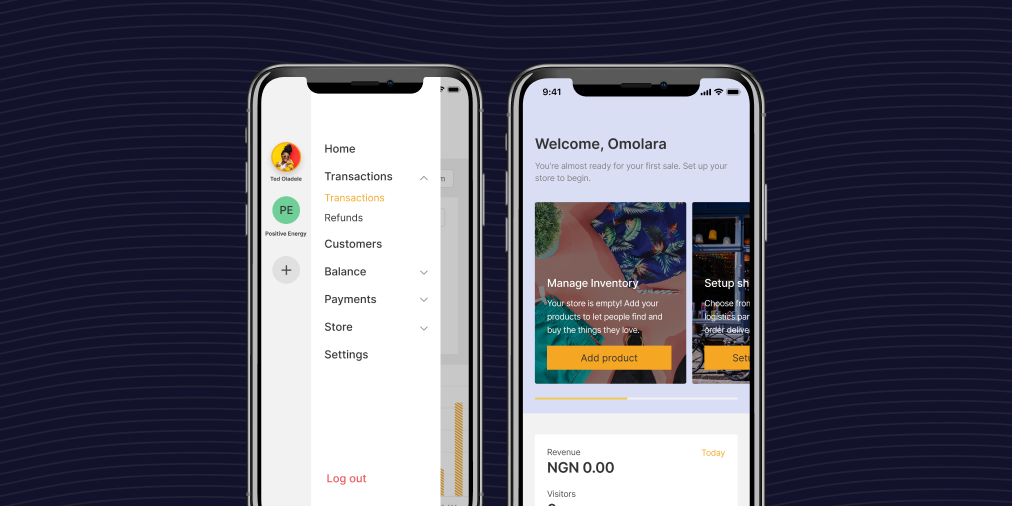

Have you tried Flutterwave Mobile today?

The Flutterwave Mobile app, the app that turns any smartphone into a mobile POS is now redefining commerce. The Flutterwave Mobile App makes it super convenient for anyone to take their business with them anywhere, anytime. Learn how you can take your business anywhere, anytime here.

Zoom in: Before Wave, there was Sendwave

Sendwave – like most fintech startups in Africa – was co-founded out of frustration by two friends: Drew Durbin and Lincoln Quirk. In 2014, Drew grew tired of the hassles and high fees associated with sending money from North America into Africa. And Drew had first had experience with the hassles of international money transfers because he regularly sent money to his NGO in Tanzania.

So instead of continuing to deal with high transaction costs and long lines, Drew built Sendwave, an app-based remittance business, with Lincoln. In a few short years, Sendwave grew to over 400,000 users and was officially acquired by Worldremit in 2021.

Sidebar: Worldremit rebranded to Zepz Pay in August of this year. As a result of the rebrand, Worldremit and Sendwave are now brands housed under Zepz.

Zepzpay.com

But before Sendwave was sold to Worldremit, Drew and Lincoln had already begun building Wave in 2016. While Sendwave was built to simplify remittances into Africa, Wave was built to truly serve Africa’s underbanked population and to lower the costs of mobile money transactions.

During the period Wave was being piloted, 60% of adults in sub-saharan Africa were unbanked due to high account fees, inaccessible bank branches, lengthy paperwork and low financial literacy rates.

Wave, among other fintech startups, crashed into the scene to offer a mobile money product that promised zero account fees, free deposits, bills payments and withdrawals. For users who want to send money, Wave only charges a 1% transfer fee.

1% transfer fee? Almost unheard of in the financial industry. But Wave kept true to its word and since it launched in Senegal in 2017, the fintech app has clocked 5 million downloads and claims to be the largest mobile money player in Senegal.

So is it any surprise that they pulled in the largest Series A round recorded in Africa’s startup industry? No, it isn’t.

Not only is Wave a social impact business, they are also profitable and stand a chance to deeply penetrate other countries in Francophone Africa, and possibly other regions including North Africa and East Africa.

Partner Message

Take control of your investing journey. Did you know that the US Stock markets have returned on average 0% annually for nearly a 100 years? Are you aware that Bitcoin has been the best returning asset-class in the past decade. Learn the basics, stay updated for free at 30%Club here.

Zooming out: Can Wave handle the heat of competition?

While Wave’s recent funding news is causing a healthy mix of surprise and excitement, the fintech startup is now tasked with the responsibility of unseating, or taking on, larger mobile money incumbents in Sub-Saharan Africa.

Since the Central Bank of West Africa States permitted nonbanks to operate mobile money transactions in its member states, mobile money adoption rates have increased, driven primarily by telecommunications operators. Wave’s fiercest competitors are telecom giants: Orange, Free and Expresso Telecom. Orange, which operates Orange money, has nearly 8 million mobile Money subscribers; Free Money (formerly Tigo Senegal) has 4.4 million active users; and Expresso Senegal has more than 3 million active users with 22% market share in Senegal.

Even though Orange Money controls around 50% of the telecom market share, the telecom operator has considered, and still considers, Wave as a threat and direct competitor. So much so that in June of this year, Orange dropped its bill payments fees to 1% – a direct response to Wave’s 1% fee on transfers.

Orange also launched Orange Morocco last year – a strategic move that could make them a leading mobile money player in the Middle East and North Africa region (MENA).

In order for Wave to imprint its palms in Africa’s mobile money market, the fintech startup must aggressively and quickly expand into other regions over the next 5 to 10 years. Wave recently expanded its services into Cote d’Ivoire in April – a clear sign that regional growth is at the top of their minds.

Wave must also remain user-focused and continue to offer low-cost and hassle-free financial services to underserved individuals and also grow its agent network across Senegal, Cote d’Ivoire and other Francophone countries.

We’re going to be following Wave’s story closely, and we hope you do as well.

Sidebar: East Africa has the highest number of registered and active mobile money accounts. The East African region, which is home to countries such Kenya, Uganda, Rwanda and Tanzania, has seen the fastest growth in mobile money accounts. Additionally, in most East African countries, there are more mobile money accounts than bank accounts.

The paypers.com

Partner Message

Meet intrepid entrepreneurs from Africa and South Asia, hear their stories and learn from Stanford University faculty how to transform today’s challenges into tomorrow’s opportunities. Listen to Grit & Growth wherever you get your podcasts.

FROM THE CABAL

Scrapays is helping Nigerians get value from waste using USSD technology.(Michael Ajifowoke, TechCabal).

MTN Group in talks with potential international buyers for its wireless business in Afghanistan (Daniel Adeyemi, TechCabal).

Why Nigeria’s vehicle financing culture is struggling to take flight (Michael Ajifowoke, TechCabal).

Sunu Capital’s approach to backing exceptional African founders (Daniel Adeyemi, TechCabal).

Have a great week

Thank you for reading Next Wave. Please share today’s edition in your WhatsApp, Telegram, and social messaging groups. Got thoughts, comments or corrections? Reply to this email and someone from the team will respond as soon as possible. We love hearing from our readers.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT). Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Editor’s note:

I’d like to make some amendments to some information I included in last Sunday’s edition of Next Wave:

“This statement was made by Yahui Zhao, OPay’s Chief Executive offer, in an emailed response to Bloomberg a few weeks ago.”

Yahui Zhuo is the correct spelling of his name and he is Chairman/CEO, Opera Ltd.