November 29th 2021

The Next Wave provides a futuristic analysis of BizTech and innovation in Africa. Subscribe here to get it directly in your inbox on Sundays at 3 PM (WAT).

African retail banking is data-rich and simply does not care.

Given how much data legacy banks must have about their customers, you’d expect them to be constantly searching for how to effectively deploy this data to improve their services.

You are a good and sensible person to expect this.

You also might as well hope for pigs to fly.

Traditional retail banking is still undeveloped beyond long queues for deposits, transfers, and withdrawals. African banks do not seem concerned about the product or service insights that they can generate from customers’ data they have gathered in compliance with regulatory requirements.

Banking equals data and vice versa

Banking has an interesting connection with data. The old merchants and financiers that precluded the modern bank loaned money to people who needed them based on what they knew about these people. This could mean giving a farmer a loan against the number of pigs in his farm or how much crop he expected to harvest, or giving loans against reputational or political capital.

As banking became more complex and central to how formal economies are designed, it became even more important for banks to know more about the customers they served. Naturally, they began to keep better records on their customers—which, as you’d expect, generated tons of data. The banker now knew better the financial habits of the customer. In more advanced economies, bankers began to leverage what they knew about their individual customers to build out personalised service offerings and simplify the banking experience for their customers.

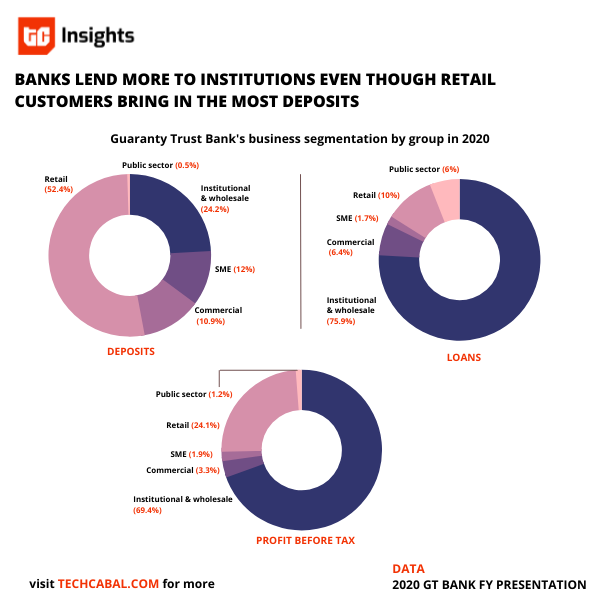

Unfortunately, this is not the case in Africa. Legacy banks still mostly focus on capturing as many retail deposits as possible, and making as much as possible from transaction fees, with little regard for what their retail customer segments need.

The reasons for this apparent lack of use for data boils down to three key facts, one of which is that retail banking is a tough thankless game of margins. Typically, retail banking serves a lot of people who make very small transaction amounts. The bank relies on massive distribution and marginally better efficiency to make profit from the transaction fees they collect. Because they have so many customers, many of whom transact relatively small amounts, banks struggle to effectively serve them in a cost-efficient way.

Partner Message

Applications are now open for the Decentralized Umoja Algorand Bounty Hack II, by Algorand and Reach. The hackathon is a great opportunity for African developers to learn & build blockchain projects and win up to $10,000 in prizes. Applications are open here until 4th March 2022.

The bankers’ solution to this problem of scale (and the need to grow retail banking deposits) was to outsource some customer operations through point-of-sale (PoS) agent banking. The problem with this is that by handing off customer operations to informal agents, the banks are only solving their problem—the problem of the cost of retail banking at scale.

Another reason banks do not effectively use the data they have is that they do not know how to. Back office staff can only process so much of the information they have about customers, and it is costly to run for relatively low margin business of retail banking. This leaves a huge chunk of the data of banks severely under-utilised. For example, Atlas Mara co-founder Ashish Thakkar claims that, “Eighty percent of information sitting in big banks today is still not being fully utilised.”

This is where innovation in artificial intelligence and machine learning algorithms like binary probabilistic algorithms, for example, can help banks understand, profile, and offer better services to their retail customers. A recent Salesforce survey has 87% of banking leaders agreeing that this type of technology will be critical for top performers.

One of the biggest reasons banks do not care about using retail banking data to improve services is that they have a more profitable option, something Ola Brown calls “magic banking”.

“Magic banking” happens when it is more profitable to lend to the government instead of smaller private sector businesses that need those loans to employ workers, grow their business and, by extension, the real economy. Unfortunately, this happens a lot. Since lending to the government is more profitable, banks simply follow the money and leave retail customers out in the rain.

Partner Message

Receive money from over 30 countries directly to your bank account or mobile wallet. Visit send.flutterwave.com and do it now!

Why is using customers’ data for banking important?

Retail customers make up the bulk of the people who use the bank. By failing to improve service delivery for customers, banks miss the opportunity to drive financial inclusion, increase employee efficiency, and improve on customer experience. Take Starbucks for example. It is obviously not a bank, but it has successfully used a flywheel of rewards, partnerships and technology to build personal relationships with its customers. Similarly, banks can use customer data to build 360° profiles that allows them to prescribe financial products that match the customers’ needs or partner with malls to reward their customers.

There may be a huge opportunity here for credit/BNPL/associated startups who can leverage technology to improve customer service and product offerings. But it is an opportunity that comes with a new set of challenges. For one, it will require serious adoption of new autonomous finance technology.

Besides, startups like Carbon or AltDrive, who are taking on this problem still have to solve the challenges of credit recovery. For one, they do not have access to the amount of data legacy banks already have about their customers. And as they are all building siloed credit offerings for different needs, a customer may not want to use such a fragmented solution.

Solving the retail banking gaps is possible, if ambitious startups or even legacy companies can crack that fragmentation problem, figure out credit recovery, and leverage data technology to better understand their customers. Until then, retail banking and the associated customer experience will continue to be a difficult experience.

Have a great week.

Thank you for reading The Next Wave. Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine, Senior Writer, TechCabal.