In Sudan, rising wheat prices have caused the price of bread to roughly double. At the end of April, the Premium Bread-Makers Association of Nigeria warned that bread prices would increase by 50% in May due to wheat scarcity. And early in March, Egyptian Prime Minister Moustafa Madbouly ordered the price of commercially sold bread to be frozen at 11.50 Egyptian pounds ($0.66) per kg. Bread is Egypt’s staple food, eaten with almost every meal. The country is also the world’s largest importer of wheat with about 80% of its wheat imports coming from Russia and Ukraine.

It is a perfect and sad irony. Food supply chain disruption caused by the Russia-Ukraine war disproportionately affects food import-dependent regions like Africa. Already rationed food in some of the worst-hit areas is being reduced. In today’s globally connected world, supply chain shocks in one country have severe consequences in other parts of the world. The result? Food insecurity.

The state of food security in Africa

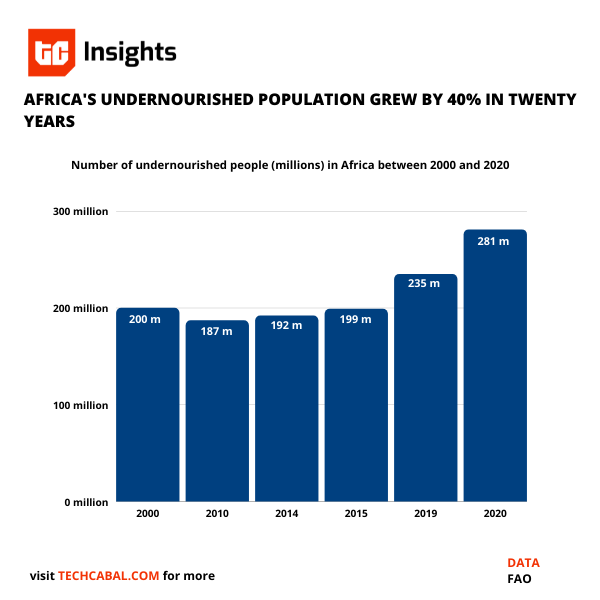

While the percentage-as-a-population of undernourished Africans has fallen steadily, more people in Africa are at risk of becoming food insecure. As of 2019, 54.2% of Africans suffered from moderate to severe food insecurity, data from the Food and Agriculture Organization of the United Nations (FAO) shows. Between 2020 and 2021, the Africa Centre for Strategic Studies said acute food insecurity increased by over 60%. The halting of supply chains globally in the wake of governments’ pandemic response exacerbated what was a severe but simmering crisis.

Food insecurity breeds social and political crises. Three years ago, Sudan’s longtime ruler, Oma al-Bashir, was removed following months of protests sparked by the rising cost of bread; and Nigeria witnessed scenes like this as people all over the country descended on stored pandemic relief that had not been distributed. One story that perhaps underscores the importance of food security is how Israel marked a turning point in their relations with the Sudanese government by sending $5 million worth of wheat alongside promises to invest in Sudanese agriculture and technology after the new transitional government decided to normalise relations with Israel.

While the percentage-as-a-population of undernourished Africans has fallen steadily, more people in Africa are at risk of becoming food insecure.

More recently, and in the context of Russia’s invasion of Ukraine, the International Committee for the Red Cross has said that more than 346 million Africans face a food security crisis that is making families skip meals every day.

Partner Message

Date: 29th & 30th of June

For more details visit: www.lagoshealthsummit.com

In specific cases like Nigeria—Africa’s largest population—data from the World Bank show that the proportion of Nigerian adults experiencing moderate or severe food insecurity rose from 48.5% in 2019 to 75.5 % in 2021. A Gallup World Poll conducted before the Russia-Ukraine war noted that 71% of Nigerians and 69% of Kenyans could not afford food in 2020. The 2 countries purchase roughly 31% and 34% of their wheat from Russia and Ukraine, respectively.

While Africa’s tiny middle class may complain about rising food prices on social media, the people who are most affected by food inflation are those earning already pitiful income, the bulk of which—about 50%, in the case of Nigeria—goes to food.

Rising up to the challenge: meeting the problem as an opportunity

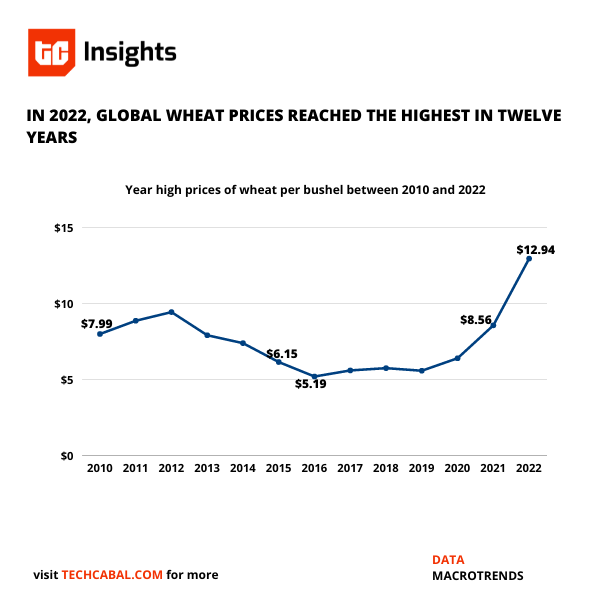

Before Russia invaded Ukraine, many countries in East, West, Central, and Southern Africa, including Angola, Cameroon, Kenya, and Nigeria, were already grappling with soaring food prices due to government policy, economic downturns, and extreme weather events like floods, droughts, and even a once-in-a-century locust invasion. Since Russia’s invasion, these prices have reached new highs. The United Nations’ Food and Agriculture Organization’s (FAO) Food Price Index—a measure of the monthly change in international prices of a basket of food commodities—is at its highest since it was created in 1990 after it increased 12.6% between February and March.

But food prices are not the only things going up. The prices of the agricultural input needed to create food are also going up. Fertiliser prices are at record highs.

More than ever, what this messy soup of disasters (COVID-19 and Russia’s invasion) highlights is the fact that Africa cannot afford to rely on external supply chains for basic food production. This brings us to an important question: “Who will feed Africa?”

The stats mentioned here are barely the most worrying. Yet regardless of what has gone unsaid, the hunger crisis is already the daily reality for millions of Africans. It is also a big market opportunity; in 2013, the World Bank estimated that Africa’s food market could be worth 1 “astonishing” trillion dollars by 2030.

Partner message

Find out more here.

Framing this as an African “opportunity” is intentional. For too long, the food aid model has been the everlasting short-term solution. It is clearly unsustainable and incredibly opportunistic because it leaves Africa vulnerable to the political and geostrategic mood swings of our “kind-hearted” donors. We can’t be activists forever and, besides, Africa’s rapid (still mostly disorganised) urbanisation and growing middle-class consumers may help generate $645 billion in consumer spending by 2025 on fresh produce, dairy, meat, processed food, and beverages, according to Africa Renewal, a United Nations publication.

However, seeing “opportunities” is one thing, and taking advantage of them is another thing. Any market opportunity worth the tag stands on the 3 legs of innovation, policy, and market action (the interaction between sellers and buyers). Already, agriculture, mostly of the subsistence variety, provides income for between 65%–70% of Africans. Higher trade taxes on African agricultural exports compared to other regions incentivises importation of food; and a combination of climate change, conflict, continuing dependence on rain-fed agriculture, and a focus on growing cash crops over food crops makes agriculture in Africa unattractive, unproductive, and even risky.

Yet transforming African agriculture into an entrepreneurial endeavour holds serious promise for solving the continent’s perennial food problem while producing a mass number of jobs and improving trade imbalance. Africa imports about $50 billion worth of food every year. Even small improvements in productivity, land management and increased use of agricultural input can have a significant impact. Per Briter data, African agritech startups have received a total of $542.2 million in funding since 2017, a paltry sum, to be honest. However, the agriculture conversation in Africa is more than just funding (there is always a need for more).

The conversation about feeding Africa starts from committing to discovering and doubling down on the troika I mentioned earlier—innovation, policy, and action—that can drive food sustainability. That is how we can build food resilience and forever end the curse of being synonymous with food insecurity and starvation. Nothing breeds innovation and swift policy like pressure; like a mixed blessing, the pressure cooker situation of today signals the best time to begin. Who will feed Africa? The answer is up in the air, but daring entrepreneurs, committed governments, and a huge market opportunity can bring those answers to life.

Have a great week!

Thank you for reading The Next Wave. Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa

| Abraham Augustine, Senior Writer, TechCabal. |