We often discuss regulation as a necessary pain in the development of innovation of any sort. How the adults need to keep watch over the tech weirdos lest they burn the house down. But to pretend that all regulation is in good faith, mature, or even pro-consumer is naive.

So what other strings influence the policing of innovation, and where are they attached and who is pulling them? For investors and entrepreneurs, understanding this will help them see why Africa’s innovation biosphere is vulnerable to political hostage-taking.

From the earliest days of human progress, political power has always been concerned about the development and use of technology, no matter how basic. In fact, a good chunk of technological progress flows from the concerns of political power and usually serves the aim of politics whether by trade or in war. Genghis Khan is probably an extreme ancient (yet fitting) image of how political power leveraged technical innovation first to build the first modern army, and then to keep the vast Mongolian empire functioning through its many bloody campaigns.

Partner Message

We Have Found More Ways For Nigerians To Make Money

We are excited to announce that Trove Finance is Nigeria’s FIRST stock trading app to launch extended-hours trading for its users! This means that Trove users can now trade on the stock market when it is closed to everyone else. Click here to learn more.

Download the Trove App and start making money today.

This is the foundation of any regulation—not the consumer, who is usually an afterthought of political strategy, but the overarching political goal of the ruling class.

Genghis Khan perished centuries ago, but global powers and wannabes—China, for example—are a clear example of the overt political supervision of innovation, sometimes ruthlessly and often with little attention being paid to what consumers want. Of course, “The State is Always Right” China is not your shining example of an open society. But even in more open (and innovative) societies like the United States, for example, the political class regularly interfere directly and indirectly in how innovation serves the strategic long-term goals of their class and the government.

One of the best examples of this is how ex-president Donald Trump’s pot shots at TikTok were almost unanimously condemned by other politicians, only for US officials to renew calls for TikTok to be cancelled barely 2 years into Biden’s presidency. First, both sides of the political class tried to score political points using TikTok, but both sides still retained the national perspective that is definitely not pro-TikTok.

The point is that like Khan before them, the politicians who ultimately control innovation via regulatory bodies prefer that it is beholden to them. Where this tension, which manifests as regulation, is not balanced, the result is a primitive mesh of knee-jerk compliance auditing.

And that is the primary problem with regulation in Africa.

Partner Message

The AltInvest App: Your Seamless Investment And Wealth Partner

Sterling Alternative Finance brings you – AltInvest, an ethical investment platform catering to the real sectors such as Real Estate, Agriculture, Sukuk bonds and more. Learn more here: https://linktr.ee/altinvest

Regulation in Africa is primitive

Being primitive is not a bad thing. It is the state of the beginning, the first building block and the foundation of all complexity. Primitive regulation is regulation that happens because someone needs to take control. And regulation in Africa is primitive because it is still primarily about those in charge.

These persons may not have a fully formed long-term strategy, goal or plan. Like the touts who self-assemble at bus stops in metropolises like Lagos to collect arbitrary levies, African regulation is either carried over from colonial interests or formed at the instance of perceived short-term threats. Worse still, regardless of how the regulation was conceived, it is usually allowed to go stale, calcify, and become traditional pillars around which special interest and regulatory arbitrage build or support monopolies.

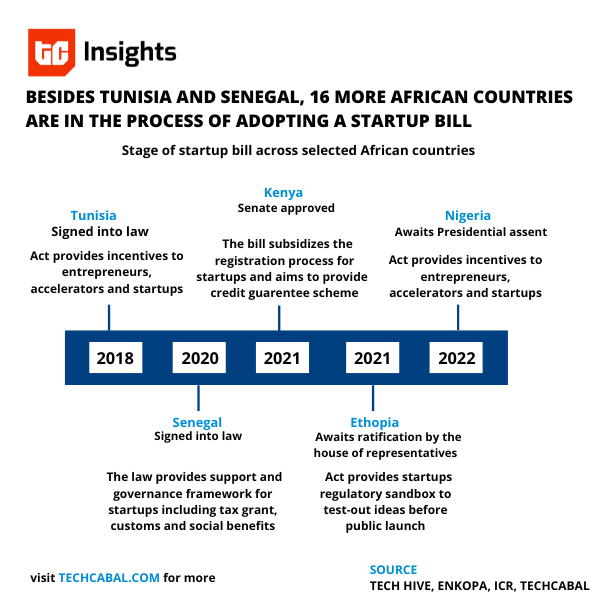

While regulatory movements like national startup laws try to gain traction across the continent, the default regulatory hedge in Africa for long has been personal or even board relationships with people who are close to the regulating bodies or who have had prior experience.

It is a valid strategy. In business, personal relationships are very important and can very often be the difference between succeeding and failing. But the weakness of this hedge is clear. Personal relationships are not law. They are often only as good as one person. Beyond the individual, regulatory hedges built upon relationships break down quickly.

Chart: Fikayo/TC Insights.

At the same time, national startup laws are only a band-aid solution. A more long-term approach will require politicians to recognise the long-term value of innovation and why it cannot simply be beholden to them. They will accept that innovation needs a healthy balance between political influence and national objectives. And alongside (ideally, before) building regulatory frameworks for early-stage technology entrepreneurs, they will understand the need for a well-thought-out and properly articulated long-term strategy.

Tongue-in-cheek policy documents, agendas and plans will not cut it. The government will need to demonstrate that it understands why digital innovation, especially, is important, for independence, healthy economies, and thriving markets.

Innovation, especially technology innovation, is a messy business, and in today’s tightly interconnected world, it has to be a strategic business. Even in the earlier days of the Industrial Revolution, governments and politicians realised the long-term value of technology products, talent, and markets. The British government famously prohibited workers who could operate textile mills from travelling out of the country for fear they would lose the technology advantage. African regulators and the political class that enables them need to grow up fast and learn that simply checking off compliance boxes is no longer the bare minimum.

•

From the Cabal

Fintech startup, Afriex facilitates money transfers in any currency, from anywhere in the world. Read more about it wants to ease remittance for Africans here.

Have a great week.

Thank you for reading The Next Wave. Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

| Until next week! Abraham Augustine, Senior Writer, TechCabal. |