Highlights:

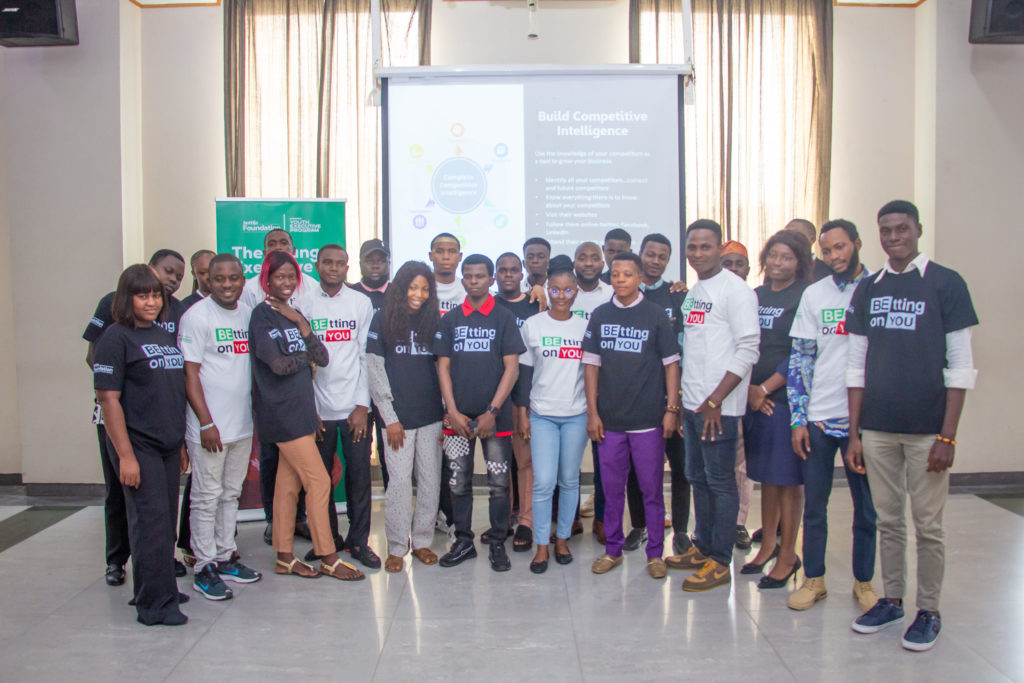

- The theme of the conference was “TechHER: Bridging the Tech Barriers, Building the Future.”

- The FMN Women’s Network is committed to supporting women in their pursuit of excellence in the field of technology.

- Participants had the opportunity to network with each other and learn from experts.

- It included a panel discussion featuring leading business and technology experts

Flour Mills of Nigeria Plc (FMN), through its FMN Women’s Network (FMNWN), successfully held its 5th annual women’s conference on Thursday, November 16, 2023, at Ebonylife, Victoria Island, Lagos. This year’s conference, which was focused on the theme “TechHER: Bridging the Tech Barriers, Building the Future,” brought together women and key stakeholders from diverse backgrounds to explore the transformative power of technology and its potential to empower women in their personal and professional lives.

The hybrid event highlighted keynote addresses and a panel discussion that featured leading technology and business experts including Prof. Olayinka David-West, an Associate Dean, Lagos Business School; Mr. Ugodre Obi-Chukwu, Founder/CEO, Nairametrics; Mrs. Rosario Osabose, MD, Tenaris Nigeria; and Mrs. Ugochi Agoreyo, Strategy Development Expert and Partnership Lead at Google. These panelists focused discussions on the power of technology and the resources it avails to individuals when it is harnessed for its underlying value.

Participants, also referred to as Amazing Amazons, had the opportunity to network with each other, learn from tech experts present, and share more insights on innovative ways of exploring the latest trends in technology for business and financial growth.

The FMN Women’s Network (FMNWN) is a demonstration of the Group’s commitment to propagating gender equality and diversity. The network provides a platform for women to connect, have access to career-boosting resources like mentorship and training, community support, and advocate for their advancement within the organization and across the country.

The event also had in attendance key stakeholders within the Group including the Chairman, FMN Board of Directors, John G. Coumantaros, who noted that “As we converge again for this year’s event, I believe that the actions from this event will be more transformational and impactful. The FMN women are among the best in class in Nigeria and globally. The FMNWN annual women’s conference is a valuable opportunity for us to bring together women from all walks of life to learn, grow, and inspire each other. We are committed to creating a more inclusive and equitable future for women in Nigeria, through innovation and technological advancement.“

In her opening remarks, Dr. Salamatu Suleiman, a member of the FMN Board of Directors, urged women at FMN to leverage the tools technology provides for their career and personal development. She emphasized, “Technology is not a barrier but a gateway to endless possibilities, empowering every woman at FMN to thrive in both her professional and personal life. In today’s fast-paced world, being tech-savvy is not merely an advantage; it’s a necessity. Let us collaboratively shape a future where our contributions are amplified, our voices resound, and our presence is felt in every corner of the industry.”

The FMNWN annual women’s conference is a testament to the organization’s commitment to empowering women and fostering a more inclusive and equitable society. Also speaking at the event was Mr. Boye Olusanya, the Group’s GMD/CEO who shared that “At FMN, we embrace the strength, resilience, and innovation that every woman brings to the table, shaping a future where equality is not just a vision but a reality. So we all must learn to take proactive and deliberate actions in creating an envisaged future through innovation and dedicated adoption of various technological advancements across all our various touchpoints”.

In her remarks, the Chairperson of the FMN Women’s Network, and the Head, Talent Academy for FMN, Olubunmi Ebhomenye noted that the FMN Women’s Conference was crucial in enhancing the individual capabilities of employees to reach their potential, which ultimately adds to the company’s overall success.

She said, “Conversations at the conference reflect the organization’s deliberate commitment to fostering diversity, equity, and inclusion. The event underscores FMN’s dedication to championing a more gender-balanced workplace, empowering all employees to excel in diverse roles. Our aim is to cultivate an environment where every individual, regardless of gender, thrives and contributes meaningfully to our collective success.“

The conference provides women with the tools, resources, and inspiration they need to succeed in their personal and professional lives and positively impact their communities and the world.

The FMN Women’s Network is committed to supporting women in their pursuit of excellence across different fields particularly in the areas of tech inclusion and adoption. The conference is an important step in bridging the gender gap in the tech industry and providing women with the tools and resources they need to succeed.

About Flour Mills of Nigeria

Incorporated in September 1960 and quoted on the Nigerian Stock Exchange since 1978, Flour Mills of Nigeria (FMN) Plc, owners of the iconic Golden Penny Food brand is one of Nigeria’s leading food and agro-allied companies. With a broad basket of food products and robust pan-Nigerian production, distribution, and supply chain network, FMN is a fully integrated and diversified food and agro-allied group.

FMN group strives in its purpose to “Feed the Nation, Everyday” through its five core food value chains: Grains, Sweeteners, Oils and Fats, Proteins, and Starches. FMN creates value along the entire food chain with its “farm-to-table” model by providing inputs and know-how to farmers, aggregating and sourcing crops and raw materials to supply its world-class processing facilities across Nigeria, and distributing its innovative food brands to its customers.

More information can be found at www.fmnplc.com Follow FMN, on Facebook, Instagram, LinkedIn, Twitter and YouTube