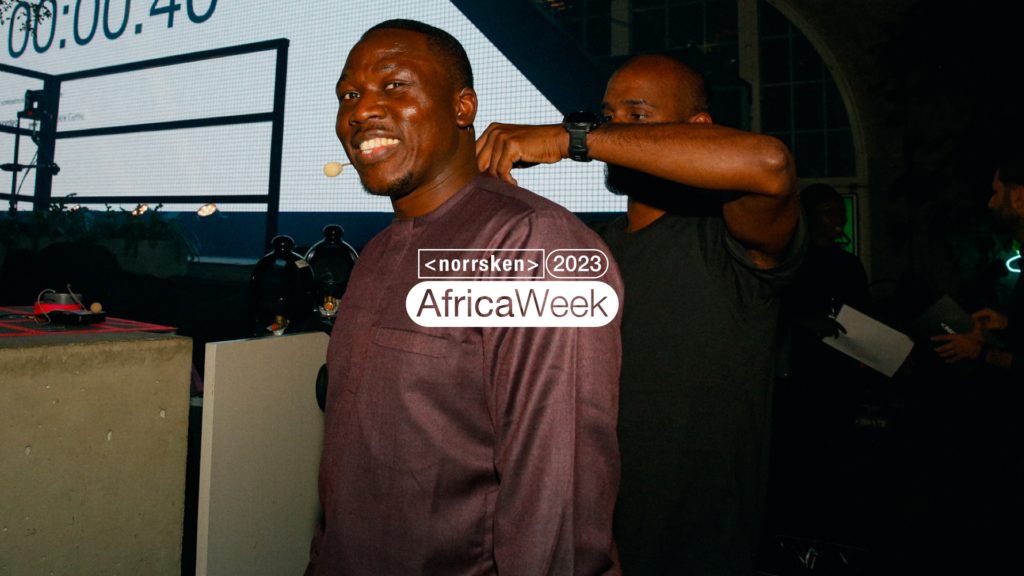

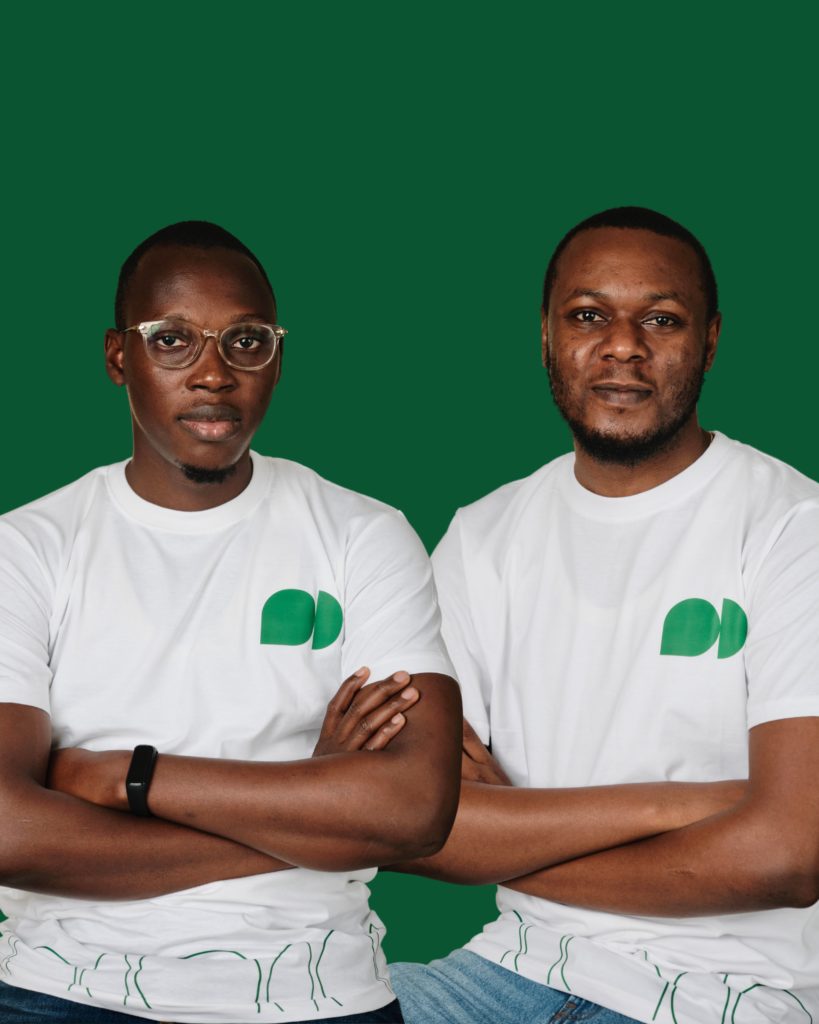

In today’s rapidly evolving financial landscape, the lending industry has witnessed a significant transformation, driven by innovative fintech companies. One such remarkable player that is about to revolutionized the loan sector is SeedFi, a digital lending platform committed to enhancing financial access, promoting responsible lending practices, and fostering financial literacy. In this article, we delve into the insights shared by Pelumi Alli, and Samaila Dogara, the co-founders of SeedFi, as they discuss the company’s journey, mission, and vision, as well as commitment to data-driven lending and customer-centricity.

A Journey Rooted in Financial Expertise

Pelumi Alli, also the CEO of SeedFi, brings to the table a wealth of experience in the banking and digital finance sector. With over a decade of experience and background in Computer Science and Business Information Systems, he, just like Dogara, held pivotal roles in renowned financial institutions, including Sterling Bank. His extensive experience in digital and operational risk management laid the foundation for SeedFi’s data-driven approach to lending.

Samaila Dogara is a highly motivated and experienced banker with over 8 years of experience in the tech industry. He has a Bachelor of Science degree (B.sc) in Finance and Investments from Ahmadu Bello University, Zaria and is passionate about using technology to solve real-world problems.

Addressing Lending Industry Challenges

The Nigerian lending landscape has faced several challenges, such as limited access to formal credit, lack of financial education, and a dearth of trust in the financial system. In a country where only 33 percent of the adult population are active borrowers, SeedFi aims to mitigate these issues through a multi-pronged approach:

Expanding Credit Access: SeedFi targets peri-urban populations, small business owners, artisans, and others who lack traditional collateral or credit history required by traditional lenders.

Providing Financial Education: SeedFi educates borrowers on building a strong credit profile, managing personal finances, and offers flexible repayment structures.

Leveraging Data: SeedFi App uses innovative credit scoring models that assess creditworthiness, providing loans to individuals and businesses with limited or no formal credit history.

According to Alli, SeedFi’s vision is a world where access to credit and financing empowers young Africans to pursue their dreams and SeedFi seeks to achieve this through the provision of flexible, convenient, and affordable digital lending solutions tailored to meet the unique needs of its customers.

SeedFi seeks to stand out among peers in the digital lending space through several features:

Reducing Principal Balance: SeedFi reduces principal balance interest calculation, ensuring customers pay less in interest charges with each repayment.

Loan Rescheduling: Customers can reschedule loan repayment dates for added convenience.

Group Lending: SeedFi’s cluster feature allows group loans, promoting accountability among members and helping maintain good credit scores.

Educational Resources: SeedFi offers comprehensive FAQs and a knowledge bank to assist users in navigating its app and accessing information about its products.

Embracing Regulatory Compliance and Data Privacy

On regulatory compliance, Dogara said SeedFi places a strong emphasis on adhering to relevant financial regulations and safeguards, including approvals from the Federal Competion and Consumer Protection Council (FCCPC), Nigeria Data Protection Regulation (NDPR) compliance, and data audits with DataPro. Moreover, the company prioritizes customer data privacy and security, ensuring that sensitive information is protected in accordance with its privacy policy.

Responsible Lending Practices and Financial Literacy Promotion

SeedFi maintains transparency and integrity by presenting terms and conditions clearly, avoiding hidden fees, and providing customers with a clear loan breakdown. The company also offers a loan rescheduling option which allows borrowers reschedule their payment for by up to 2 weeks, to match their cashflow timing.

Alli asserts that the company supports financial literacy by sharing educational content through its social media platforms and its knowledge base. This empowers users to make informed financial decisions, better manage their credit profiles, and improve their financial well-being.

Adaptability, Future Expansion and Growth

SeedFi relies on data-driven insights to remain adaptable to changing customer needs and evolving industry trends. The company’s focus on leveraging data enables it to maintain a competitive edge in the digital lending space.

Its long-term plans include expanding its offerings to include mid to long-term funding solutions for business and corporate entities, addressing operational needs and projects.

The future of the sector is bright as the lending industry is undergoing a significant transformation, with fintechs playing a pivotal role. As digital financial services gain popularity, the demand for flexible, transparent, and data-driven credit solutions is on the rise. SeedFi is poised to thrive in this evolving landscape by leveraging its data-centric approach and customer-centric vision.

Conclusion

SeedFi, under the leadership of Pelumi Alli and Samaila Dogara seeks to be the game-changer in the lending industry by addressing the challenges faced by borrowers and lenders alike through data-driven solutions, transparency, and financial education.

With its commitment to responsible lending practices and a customer-centric approach, SeedFi is not only transforming the lending sector but also paving the way for a more financially inclusive future for Africans.